Our fight continues.

If you are able, please donate today to ensure we have the resources to elect Democrats down the ticket ready to hold the Trump administration accountable.

A Plan to Lower Costs and Create an

Opportunity Economy

Vice President Harris and Governor Walz are charting a New Way Forward—to a future where everyone has the opportunity not just to get by, but to get ahead. They grew up in middle-class families and believe that when the middle class is strong, America is strong. That’s why building up the middle class will be a defining goal of their Administration.

They know that prices are still too high for middle-class families, which is why their top economic priorities will be lowering the costs of everyday needs like health care, housing and groceries and cutting taxes for more than 100 million working and middle-class Americans.

Vice President Harris and Governor Walz will create an Opportunity Economy where everyone has a chance to compete and a chance to succeed—from buying a home to starting a business and building wealth. They will bring together workers, community leaders, unions, small business owners, entrepreneurs, and great American companies to remove barriers to opportunity, revitalize communities, create jobs, grow our economy, and propel our industries into the future—in rural areas, small towns, suburbs, and big cities.

In an Opportunity Economy, more Americans can experience the pride of homeownership. Vice President Harris and Governor Walz have a plan to end the housing shortage and lower prices, partnering with the private sector to build 3 million additional homes. As these new homes are built, the Harris-Walz Administration will also give a historic $25,000 in down-payment assistance to help more Americans buy their first home and provide shelter, opportunity, and security for their loved ones.

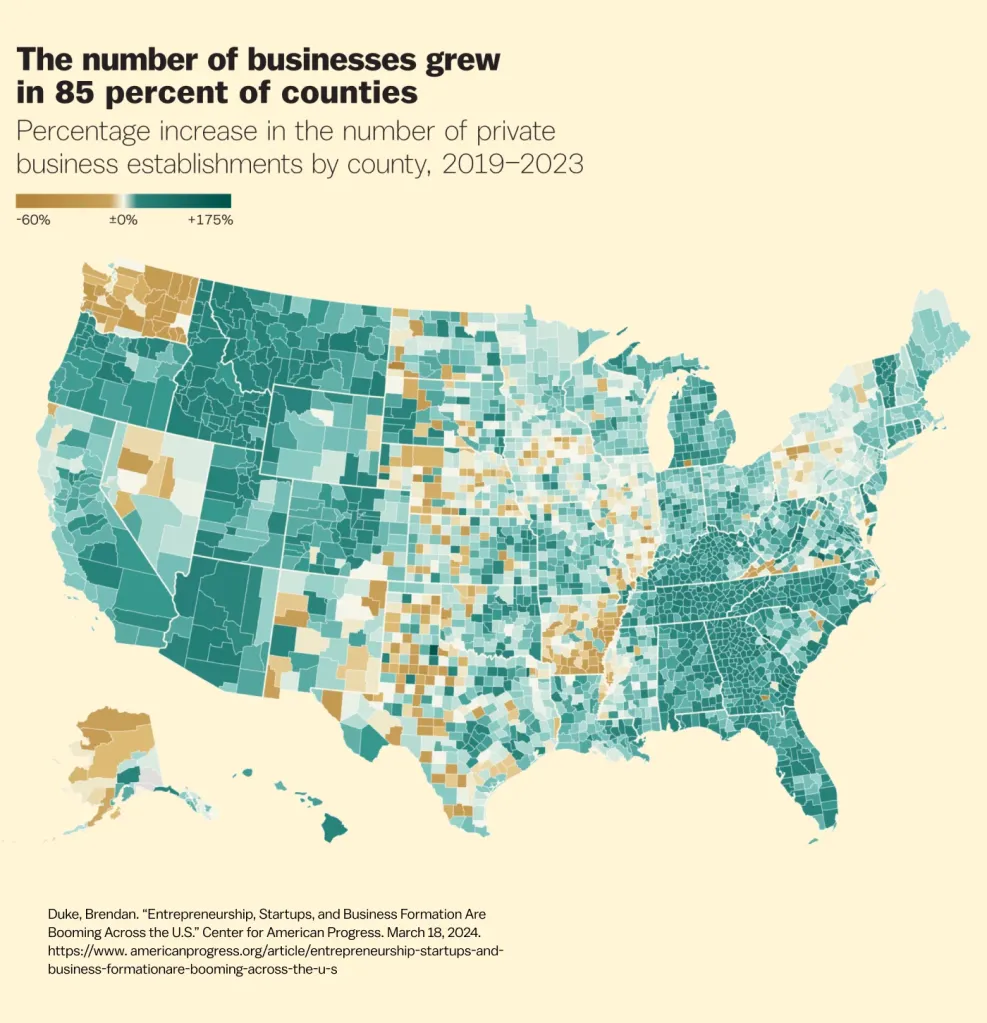

Vice President Harris and Governor Walz know that small businesses—neighborhood shops, high-tech startups, small manufacturers, and more—are the engines of our economy. As part of their agenda, they have put forward a plan to help small businesses and entrepreneurs innovate and grow, which the Vice President aims to have spur the creation of 25 million new business applications. Their plan includes expanding the start-up expense tax deduction for new businesses tenfold and taking on the everyday obstacles and red tape that make it harder to grow a small business.

They will invest in the competitive advantages that make America the strongest nation on Earth—our workers, innovation, and industry—so that America remains a leader in the industries of the future. They will revitalize American manufacturing, strengthen our industrial base, and invest in cutting-edge technologies. They will create workforce programs that work for all Americans and strengthen the care economy, opening pathways to the middle class for more Americans that don’t require a college degree. And they will protect Social Security and Medicare against relentless attacks from Donald Trump and his extreme allies and will strengthen these programs for the long haul so that Americans can count on retiring with dignity and getting the benefits they earned.

It’s time to finally turn the page on Trump and chart a New Way Forward—one in which Americans have the opportunity to create a better life and future for themselves and their families. Vice President Harris will be a president for all Americans, a president who unites us around our highest aspirations, and a president who always fights for the American people. As a prosecutor, Attorney General, Senator, and now Vice President of the United States, that has always been her life’s work.

Nearly 100 business leaders agree that electing Vice President Harris “is the best way to support the continued strength, security, and reliability of our democracy and economy.” 1

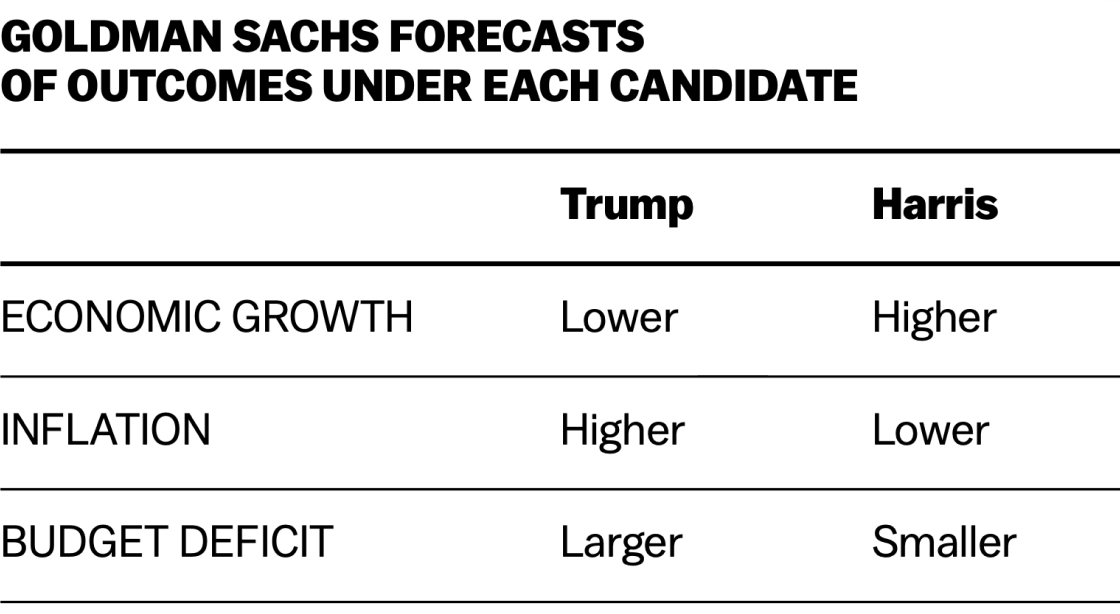

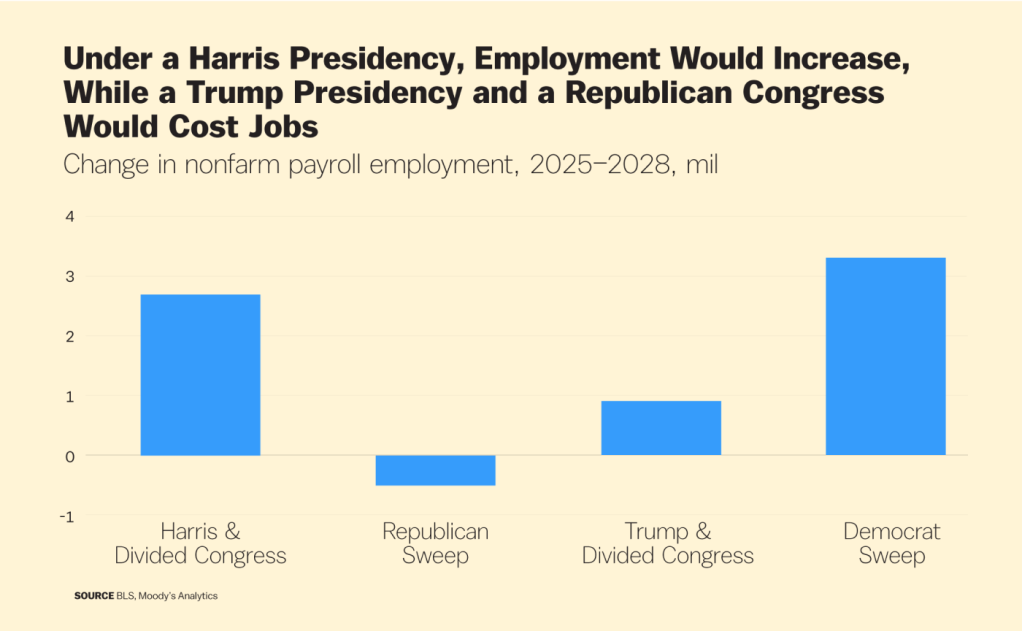

Goldman Sachs estimates the biggest boost to the U.S. economy from a Vice President Harris win. They estimate that job growth will be higher and inflation lower than if Donald Trump is elected. A Harris victory would lead to between 10,000 and 30,000 more new jobs per month than if Trump is elected.2

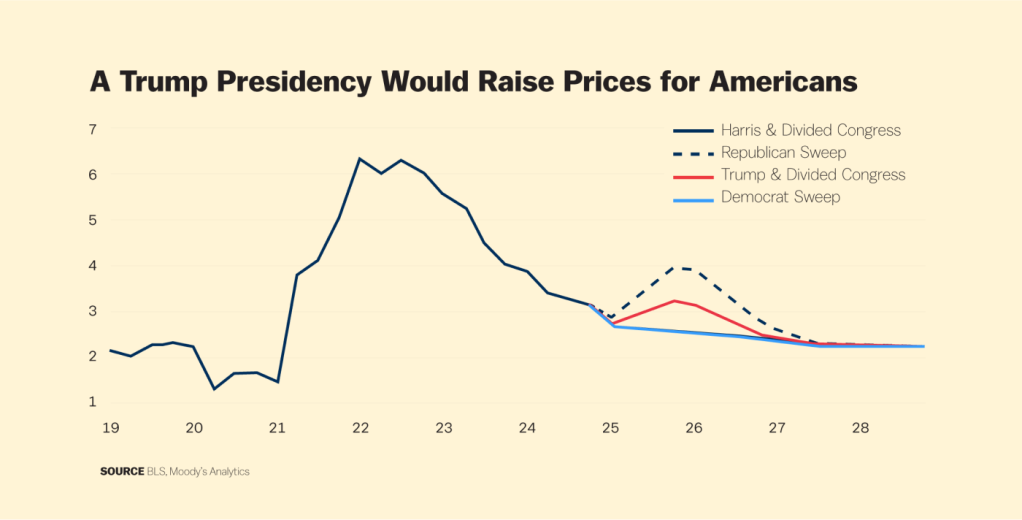

An analysis by Moody’s Analytics shows that, under a Harris presidency, more than a million new jobs would be added to the economy and household disposable income would rise more than under a Trump presidency. Moody’s finds that Trump’s plan would cause a recession by mid-2025, cost 3.2 million jobs, add over 1 percent to inflation, and reduce middle-class families’ incomes by $2,000.3

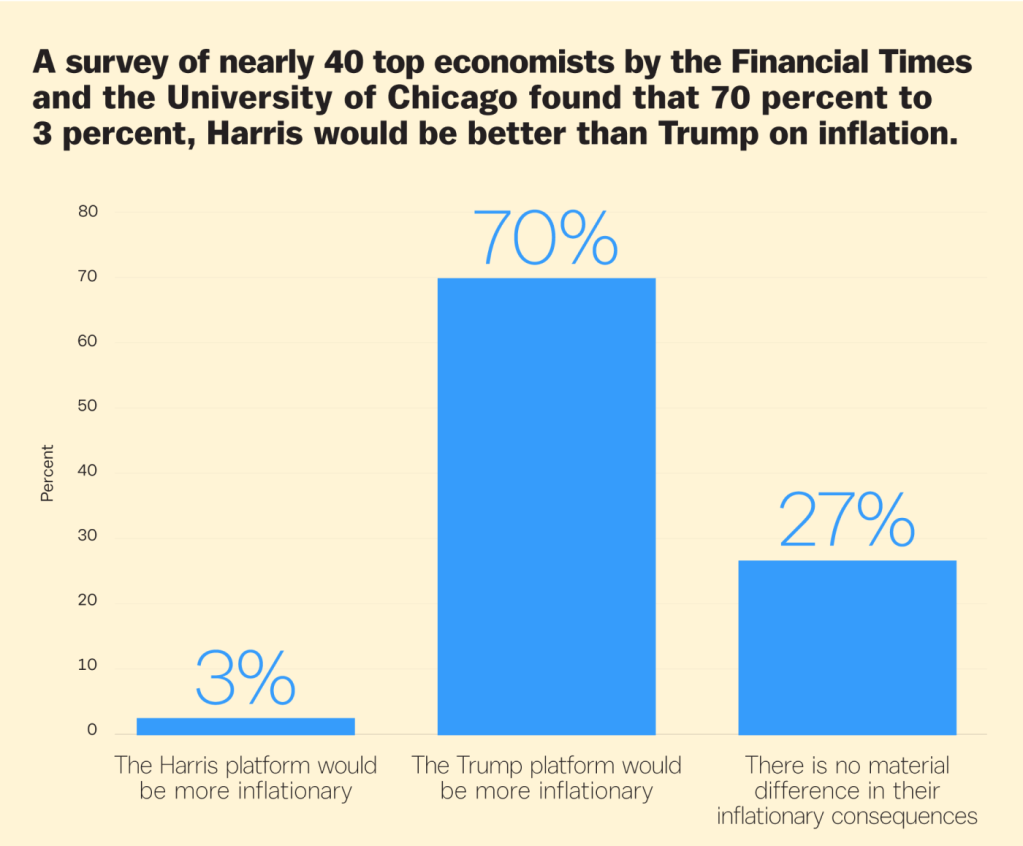

A survey of nearly 40 top economists by the Financial Times and the University of Chicago found that 70 percent to 3 percent, Harris would be better than Trump on inflation.4

Economists at Nomura agree that Trump’s across-the-board tariffs would reduce global growth and increase inflation in the United States by almost 1 percentage point.5

Even the conservative-leaning American Action Forum and Tax Foundation found that Trump’s tariffs would raise costs for American families and businesses. The American Action Forum found that Trump’s tariffs would increase costs by $4,000 per year6 and an economist at the Tax Foundation noted that tariffs as high as some of the ones Trump has threatened “will almost certainly increase the risk of a recession.”7

A survey of 40 nearly top economists by the Financial Times and University of Chicago found that 70 percent agree that Vice President Harris would be better on the deficit than Trump, while only 11 percent believe that Trump would be better on the deficit than Harris.8

A Yale economist using estimates from the Budget Lab at Yale and the Committee for a Responsible Federal Budget, emphasize Harris’s plan is more fiscally responsible. They note: “Any fair fiscal comparison shows this election is not a close call. If the deficit is your top issue, Harris is the clear choice.”9

This sentiment was echoed by the Penn Wharton Budget Model and the Tax Foundation. The Penn Wharton Model found that Trump’s tax and spending proposals would increase primary deficits by $5.8 trillion over the next 10 years,10 while the Tax Foundation noted that Trump’s plan to remove revenue from Social Security “is unsound and fiscally irresponsible.”11

The Wall Street Journal agrees: “Vice President Harris, the Democratic nominee and GOP rival Donald Trump aren’t the same on fiscal policy. She has outlined or endorsed enough fiscal measures—tax increases or spending cuts— to plausibly pay for much of her agenda. He has not.”12

Vice President Harris and Governor Walz believe that working families should have the economic stability and security they need to not just get by but to get ahead. They know that millions of families are strained by higher costs and that tax relief will help middle-class Americans take care of themselves and their families.

A NEW WAY FORWARD:

What Vice President Harris and Governor Walz Will Do

Vice President Harris and Governor Walz will cut taxes for 100 million Americans. And, unlike Donald Trump, whose Project 2025 agenda would raise taxes on the middle class, Vice President Harris and Governor Walz will make sure no one earning less than $400,000 a year will pay more in taxes.

Restoring the Expanded Child Tax Credit to Up to $3,600 to Help More Than 100 Million Americans

The expansion of the Child Tax Credit—made possible by Vice President Harris’s tie-breaking vote—was one of the largest tax cuts ever passed for the middle-class. It gave middle-class families the help they needed to pay their bills— with 70 percent of parents reporting that the monthly relief made them less stressed about household expenditures.13 For millions of middle-class working families, the expanded Child Tax Credit helped them pay their mortgage or rent, buy food, and purchase basics for their kids, like books, diapers, clothes, and toys.14 While the extension of this vital tax relief for working families was blocked by Republican opposition in Congress, Vice President Harris and Governor Walz have proposed to restore the expanded Child Tax Credit and to make it the permanent law of the land. It will provide a tax credit of up to $3,600 per child for the middle class and the most hard-pressed working families with children.

The temporary middle-class tax relief in 2021 cut taxes for more than 40 million working families with over 60 million children. The benefits of the expanded Child Tax Credit were widespread. It provided tax relief to the families of more than 9 million children in rural areas15 and 5 million children in veteran and active-duty families.16 The Child Tax Credit payments were delivered reliably with the first-ever monthly payment, delivered on the 15th of each month, with 90 per- cent of recipients using direct deposit.

Economists found that this investment cut child poverty to a record low. This support helped cut Black child poverty by over 50 percent and Hispanic child poverty by 43 percent, and it led to dramatic drops in Native American, white, and Asian American, Native Hawaiian, and Pacific Islander child poverty rates.17 In addition, Vice President Harris’s monthly tax relief model cut food insecurity by more than 20 percent among families with children.18

A New $6,000 Tax Cut to Help Families Pay for the High Costs of a Child’s First Year of Life

Vice President Harris’s plan includes a historic expansion of the Child Tax Credit: providing $6,000 in tax relief for middle-income and low-income families for the first year of their child’s life. This is often when a family’s expenses are highest—with formula, diapers, car seats and other costs— while at the same time too many parents are forced to forgo income as they take time off from their job without any paid leave. Indeed, most families’ incomes significantly decline during their child’s first year of life.19 A substantial body of research has found that the first year is the most important period of development for children and has long-lasting effects on future “learning, behavior, and health.”20

The Vice President’s plan to cut taxes for middle-class families and lower-income families with this expansion of the Child Tax Credit is backed by significant economic evidence.

Researchers have found that expanding the Child Tax Credit returns as much as $15 to society for every $1 investment through improvements in children’s health, education, and future earnings.21

The $4,000 Trump Tax: Donald Trump has a very different vision. He has offered a plan to enact what is in effect a national sales tax on all products used by everyday families that are imported, from groceries to clothes to gas to prescription drugs. This tax has been estimated to cost a typical American family nearly $4,000 per year.24

Expanding the Earned Income Tax Credit to Cut Taxes for Millions of Workers

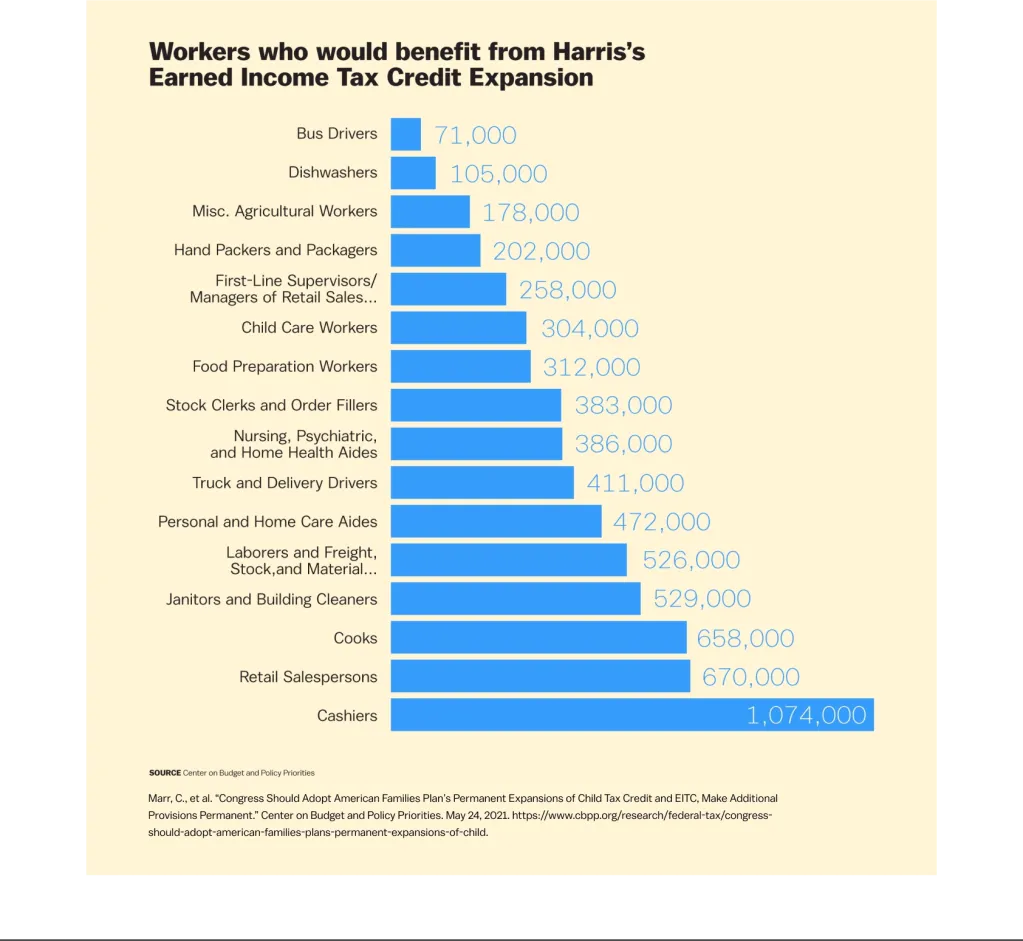

Vice President Harris believes that our tax code should work for working Americans. She supported the first increase in three decades to the Earned Income Tax Credit (EITC) for workers who aren’t raising a child in their home. The Earned Income Tax Credit is a federal tax cut that boosts the incomes of and lowers taxes for low-to-moderate income workers. Vice President Harris’s expansion tripled the maximum tax cut for these workers to more than $1,500 for 2021.

She also expanded the age range of eligible workers who could claim the credit—including for older workers who were excluded before this reform. This expansion cut taxes for 17 million American workers—including 1.1 million cashiers, 670,000 retail salespeople, 658,000 cooks, 529,000 janitors, and millions of other workers.22

This policy worked. The Center on Poverty and Social Policy at Columbia University found that the 2021 EITC expansion “led to a significant decrease in housing hardship among low-in- come, childless, young adults, and suggestive evidence that it also reduced food insufficiency and difficulty with expenses.”23 Now, Vice President Harris is proposing an expansion of the Earned Income Tax Credit to cover individuals and couples in lower-income jobs, who are not raising a child in their home, to cut their taxes by up to $1,500.

Americans across the country have been struggling with rising prices at the grocery store, leaving families’ budgets pinched even as corporate profits have increased. In just the past several years we have seen insufficiently resilient supply chains in the face of disruptions from the pandemic and then Russia’s invasion of Ukraine, as well as a lack of competition in markets. Although inflation has significantly declined—with monthly grocery price inflation at or near 0 percent—families are seeing grocery prices in many areas that are significantly higher than before the pandemic struck.

A NEW WAY FORWARD:

What Vice President Harris and Governor Walz Will Do

Vice President Harris and Governor Walz have a plan to bring down Americans’ grocery costs.

First, Vice President Harris will invest in building resilient food supply chains. The Vice President will build on progress made to strengthen and diversify our supply chains for food production, processing, and distribution. Many food supply chains still remain too concentrated, allowing for single points of failure if a plant goes down or a drought or pest affects a particular region. Vice President Harris will focus on expanding production among new suppliers and small farms, growers, and processors to create broad-based supply chains.

Second, she will revitalize competition in food and grocery prices, because a healthy and competitive marketplace means lower costs for consumers. She will direct her Administration to crack down on unfair mergers and acquisitions that give big food corporations the power to jack up food and grocery prices by instructing agencies to specifically evaluate the risk that a proposed merger would raise grocery prices for consumers. On top of this, she’ll instruct her Administration to focus on investigating and prosecuting price-fixing—where companies illegally collude to set prices—up and down food supply chains. Finally, she will make sure the federal government has the resources to identify and take on anti-competitive practices in the food and grocery industries.

In addition, she will support giving small businesses, grocers, and growers the resources to compete, reinjecting competition back into our food markets and lowering costs for Americans. This includes proposing more funding and support for new small businesses that can grow into competitors. This will build on the billions in assistance this Administration has already provided to small producers, processors, distributors, family farms, and food and farm workers to compete with large conglomerates.

Third, she will call on Congress to pass the first-ever federal ban on price gouging. The bill will set rules of the road to make clear that big corporations can’t unfairly exploit consumers during times of crisis to run up excessive corporate profits on food and groceries.

It is well established that price fluctuations are normal in free markets, that increased input costs can spur price increases to maintain normal profit margins, and that pricing can at times signal to markets to increase supply. But while most companies play by the rules, corporations should not be able to exploit times of crisis to excessively and indefensibly increase their profit margins at the expense of American families. Evidence suggests that in some cases, this is exactly what has happened. In an investigation into grocery supply chains during the pandemic, the Federal Trade Commission recently found that some food and beverage retailers saw their revenues rise much faster than costs in recent years. Indeed, the CEO of a major grocery corporation told investors in June 2022 that “a little bit of inflation is always good for our business.”25

Vice President Harris and Governor Walz’s proposal—like many of the laws already on the books in 37 states—will go after nefarious price gouging on essential goods during emergencies or times of crisis. When an emergency strikes, the American people deserve to know the government can take on bad actors that take advantage of a crisis to excessively jack up prices.

Going after price gouging by bad actors who exploit crises is a bipartisan, common-sense solution that has been embraced by Republican and Democratic governors and state attorneys general to confront inflation and lower costs in their states:

TEXAS

Under the Texas Deceptive Trade Practices-Consumer Protection Act, it is unlawful to take advantage of a disaster declared by the Governor of Texas in order to: “[Sell] or leas[e] fuel, food, medicine, lodging, building ma- terials, construction tools, or another necessity at an exorbitant or excessive price; or [Demand] an exorbitant or excessive price in connection with the sale or lease of fuel, food, medicine, lodging, building materials, construction tools, or another necessity.”26

The Law in Action: During Hurricane Harvey in 2017, the Texas Attorney General’s office received more than 500 complaints regarding price increases, including reports of up to $99 for a case of water, hotels quadrupling their prices, and fuel being sold for $4-$10 per gallon. Ultimately, the state filed lawsuits against three businesses—Robstown Enterprises (a hotel that charged three times its normal rate during Harvey), Bains Brothers (an owner of gas stations that charged $7 per gallon), and Encinal Fuel Stop (a gas station that charged $9-$10 per gallon)—and settled several of the lawsuits when the companies agreed to refund customers.27

NORTH CAROLINA

Under North Carolina’s price-gouging law, it is illegal “for any person to sell or rent or offer to sell or rent any goods or services which are consumed or used as a direct result of an emergen- cy or which are consumed or used to preserve, protect, or sustain life, health, safety, or economic well-being of persons or their property with the knowledge and intent to charge a price that is unreasonably excessive under the circumstances.”28

The Law in Action: Since 2018, the North Carolina Department of Justice, led by Attorney General Josh Stein, has recovered more than $1 million for consumers by bringing 12 lawsuits against 29 defendants. Through those lawsuits, Attorney General Stein obtained 14 judgments or settlements against 25 of the defendants, including a $274,000 settlement—the largest price gouging settlement in the state’s history.29

NEW YORK

New York’s price-gouging law makes it illegal during “any abnormal disruption of the market for goods and services vital and necessary for the health, safety and welfare of consumers or the general public … to sell or offer to sell any such goods or services or both for an amount which represents an unconscionably excessive price.”30

The Law in Action: In August 2020, New York Attorney General Letitia James brought a lawsuit against Hillandale Farms Corporation for price-gouging eggs during the pandemic. In January 2020, Hillandale charged some stores prices ranging from $0.59 to $1.10 for a dozen eggs.31 In mid-March, however, Hillandale raised that price to $1.49. In the months that followed, Hillandale charged a price for a carton of eggs that was almost five times the price the company charged in January. New York settled the lawsuit with Hillandale in April 2021.32 In 2022, after a recall of baby formula products by Abbott Laboratories, the state of New York brought charges of price gouging against Walgreens, alleging that Walgreens sold more than 3,400 cans or bottles of baby formula at “unconscionably” high prices. Walgreens ultimately settled the charges for a $50,000 payment and the donation of 9,564 canisters of formula to benefit low-income New Yorkers and infant children.33

FLORIDA

Florida’s price-gouging law makes it illegal to, during a state of emergency declared by the Governor, rent, sell, lease, offer to rent, sell, or lease essential commodities, dwelling units, or self-storage facilities at an unconscionable price. The law defines an unconscionable price as one that grossly exceeds the average price during the thirty days prior to the disaster declaration. Businesses can demonstrate that the price was not unconscionable by showing increases in its costs or identifying relevant market trends.34

The Law in Action: Florida’s Attorney General brought three lawsuits against Florida motels for price gouging during Hurricane Matthew in 2016. First, more than twenty guests staying at a Days Inn in Tampa during Hurricane Matthew in October 2016 had been charged between $89 and $209 per night.

Those rates were between 72 percent and 303 percent higher than the hotel’s average rate of $50 over the previous two months. When Hurricane Matthew was over, the Days Inn reduced its prices to its pre-hurricane levels. A second suit was brought against the Red Roof Inn in Clearwater. The complaint alleged that its room-rental rates had been raised by 89 percent to 238 percent during the state of emergency. A third lawsuit was filed against a Sleep Inn & Suites in Lakeland. The complaint alleged that the motel’s rates had been unconscionably raised during the state of emergency. At least 25 guests were reportedly charged between $124 and $264 per night during the hurricane evacuation period, which was an increase of 143 percent to 417 in rates that existed before the hurricane hit.35

Meanwhile, Trump has no plan to lower costs for Americans—in fact, under his agenda, prices for a typical American family would soar by nearly $4,000 annually. The effective national sales tax Trump is proposing on all daily goods that are imported would increase prices for a typical family by almost $4,000, including for staples like food, clothing, gas, and medicine. Multiple studies have shown that this national sales tax on family goods that are imported will have high cost increases for families.36 For example, he would place tariffs on coffee, bananas, and seafood, which there is little production of in the United States—the United States produces almost none of the coffee or bananas consumed and imports 75 to 80 percent of seafood—but which are staples for many American households.37 Indeed, an economist at the Tax Foundation has found that the Trump sales tax would raise costs for families by $6,000 each year.38

When asked recently about his plan to bring down food prices, Trump responded that he would block food imports from entering the country—an action that experts agree would raise food costs and cause food shortages without increasing food production here in the United States.39 Many agricultural products that American families rely on every day, such as bananas and coffee, can only be grown in the United States at a much higher cost than if they were grown elsewhere.40 Rigidly requiring that American families can only access food grown here in the United States would simply raise costs and reduce access to everyday food items that working families need.

And one only needs to look to his record to see that a second Trump term would make consolidation in the food industry even worse. When Trump was in office, he gave Big Ag corporations and the wealthiest Americans tax handouts. Similarly, the assistance he gave farms to help withstand his trade war with China went mostly to the biggest companies, with nearly two-thirds of the funding going to the top 10 percent of applicants rather than to family farms.41

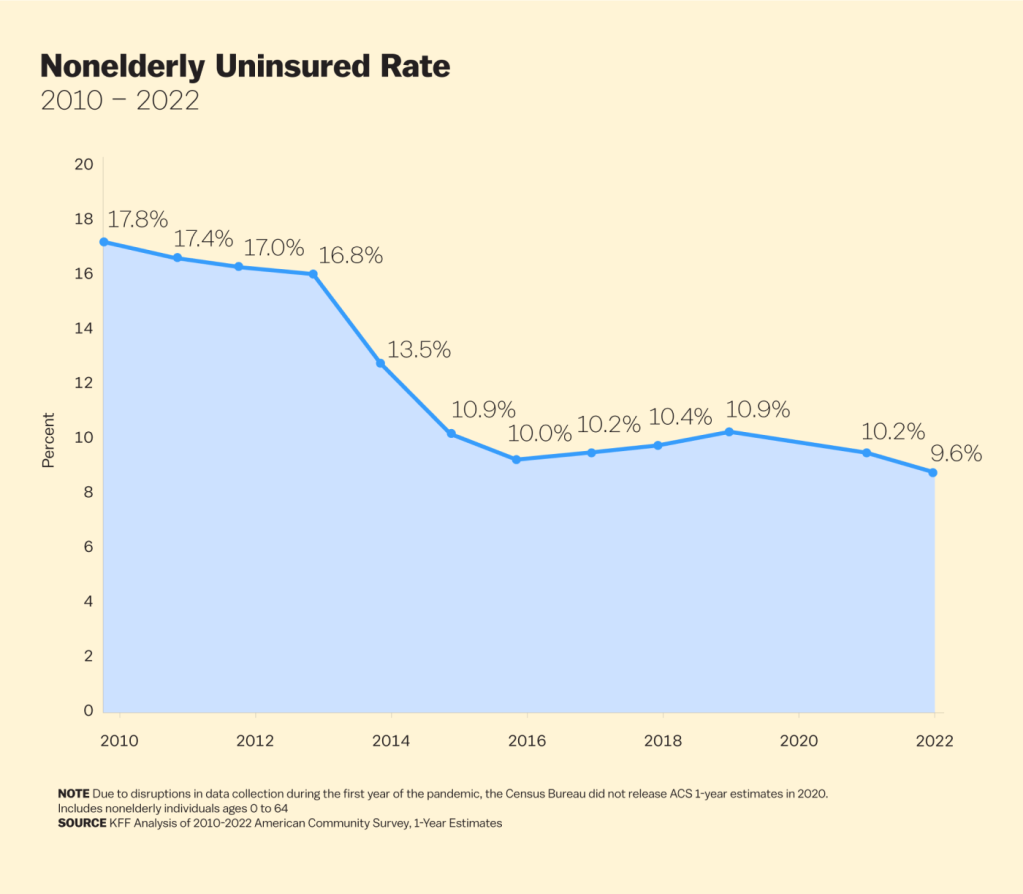

Since the passage of the Affordable Care Act (ACA), and with the strengthening of the ACA’s protections under Vice President Harris’s leadership, we have made dramatic strides in expanding health care coverage.

Today, nine in ten Americans are insured—the highest insured rate in history.42 During the Biden-Harris Administration, 9 million more Americans obtained health insurance coverage through the ACA, bringing the total number of Americans insured through the marketplaces to a record 21 million Americans.43 Nearly ten million more Americans are enrolled in Medicaid than before the pandemic, in large part because of new policies to help states expand Medicaid coverage. Despite the progress made by the Biden-Harris Administration, affordable health care still remains out of reach for too many Americans. Furthermore, nearly 41 percent of American adults are burdened by medical debt, carrying a total of $220 billion in unpaid medical expenses.44

A NEW WAY FORWARD:

What Vice President Harris and Governor Walz Will Do

Vice President Harris and Governor Walz believe that affordable health care is a right, not a privilege. A Harris-Walz Administration will build on the successes of the Biden-Harris Administration to make health care less costly and more accessible to more Americans.

Vice President Harris will expand and make permanent the tax credit enhancements for Affordable Care Act marketplace plans. Vice President Harris cast the tie-breaking vote on legislation that has saved millions of Americans an average of $800 a year on their health insurance premiums. More broadly, the Affordable Care Act has saved Americans more than $6,000 per year on average.45 Because of these efforts to lower costs, millions of Americans have been able to afford health care coverage on the marketplace, driving the lowest uninsured rate in American history. Now, Vice President Harris has a plan to make these health care tax savings for working and middle-class families permanent.46 Vice President Harris will also increase competition and demand transparency in the health care industry, starting by cracking down on pharmaceutical middlemen that increase prices by limiting competition.

Vice President Harris will also strengthen health care for veterans. Since its enactment two years ago under the Biden-Harris Administration, the Sergeant First Class Heath Robinson Honoring our Promise to Address Comprehensive Toxics (PACT) Act has expanded screenings, health care, and benefits for millions of veterans, with more than one million claims approved. Vice President Harris and Governor Walz will keep working to implement this law and support veterans so that they receive the benefits they earned through service to our country.

In addition to lowering health care costs and strengthening access to care and benefits for veterans, Vice President Harris will work with states to help them enter into agreements with hospitals and other health providers to relieve medical debt for more Americans, and help create plans to prevent debt accumulation in the future. She knows that taking smart, measured actions to relieve Americans of medical debt—often incurred through serious, unexpected emergencies through no fault of their own—will provide them the breathing room needed to start businesses, become homeowners, and more. Her proposal builds on her work to erase medical debt from the credit reports of Americans, raising their credit scores by an average of 20 points and giving them the peace of mind they need to pursue their dreams.47 It also comes after Vice President Harris worked with cities and states through the American Rescue Plan to eliminate $7 billion of medical debt for nearly 3 million Americans.

Vice President Harris will also help tackle the opioid crisis and help Americans access treatment. As Vice President, she has already helped to direct more than $160 billion to disrupt the flow of illicit drugs and stop record amounts of fentanyl from crossing our borders. Vice President Harris and Governor Walz have also both been advocates for getting individuals in need access to substance abuse treatments. If elected, they will continue to stand-up to drug traffickers and pharmaceutical companies, while also working to help those struggling with addiction get the treatment they need.

Meanwhile, Trump wants to repeal the Affordable Care Act and strip millions of Americans of their health care coverage. Donald Trump and his Project 2025 Agenda would take us back to a world in which insurers could deny coverage based on pre-existing conditions, where they could charge women more than men, where families with a loved one with a serious physical, intellectual or developmental disability faced higher costs or were denied coverage altogether, and where older adults paid higher health care premiums based on their age. If he returns to office, Trump would—all in his own words—“terminate” the Affordable Care Act with only “concepts of a plan” to replace it. Put another way, Trump would strip 21 million people who currently get health care coverage on the marketplace of their coverage and kick millions more off of Medicaid. Trump and Vance would put pregnant women and people with pre-existing conditions—including those with disabilities—into separate “high-risk pools,” where they would be forced to pay astronomically high premiums to receive basic care. Under their plan, more than 100 million Americans with pre-existing conditions could be denied coverage or charged thousands of dollars more for health insurance coverage. Vice President Harris and Governor Walz know we can’t go back to that.

Vice President Harris and Governor Walz believe that no American should have to choose between filling their prescription and putting food on the table. That’s why, as California’s Attorney General, the Vice President held Big Pharma accountable for deceptive and illegal practices, winning $7 billion on behalf of Americans in lawsuits brought against their unsafe and unfair tactics.48 And that’s why Vice President Harris, along with President Biden, took on Big Pharma and won. They lowered out-of-pocket drug costs for millions of seniors by passing the Inflation Reduction Act, which allowed Medicare to negotiate drug prices with big pharmaceutical companies for the first time ever and placed a $2,000 cap on all out-of-pocket drug expenses. In 2026 alone, American taxpayers are predicted to save $6 billion on prescription drug costs and people enrolled in Medicare are anticipated to save $1.5 billion in out-of-pocket costs, just from Medicare price negotiation.49 On top of that, the administration succeeded in capping insulin at $35 for American seniors—many of whom, prior to the Inflation Reduction Act, were paying as much as $400 a month for this lifesaving treatment.50 Because of the Biden-Harris Administration’s leadership, the largest inhaler manufacturers cut their prices for many patients to $35 a month, saving Americans who need these devices to breathe hundreds of dollars a year.51

Even with this important progress, Vice President Harris knows that there is more work to do. Americans spend more than twice as much on prescription drugs as citizens from many other countries do.52 In fact, on average, Americans pay two-and-a-half times more than citizens in other countries for the same drugs.53 Nearly 10 million Americans report not taking their medication as prescribed because of cost concerns.54

A NEW WAY FORWARD:

What Vice President Harris and Governor Walz Will Do

Vice President Harris and Governor Walz will chart a New Way Forward that not only protects these achievements but builds on them by expanding the Inflation Reduction Act’s cost-saving provisions to benefit all Americans.

Americans deserve the peace of mind that comes with knowing that they can afford the medications they need. Vice President Harris and Governor Walz will never stop fighting to lower prescription drug costs for Americans.

They will:

Vice President Harris and Governor Walz know that for working families to not just get by, but get ahead, the cost of energy needs to come down. That’s why Vice President Harris proudly cast the tie-breaking vote for the Inflation Reduction Act, which was the single largest investment in energy production in American history, and has presided over historic progress in this sector.

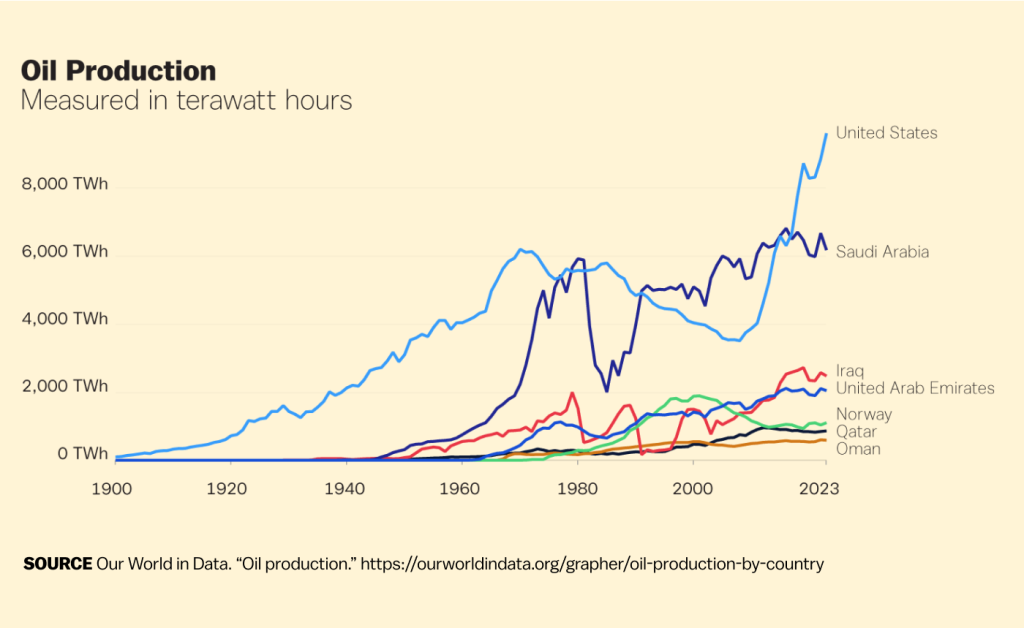

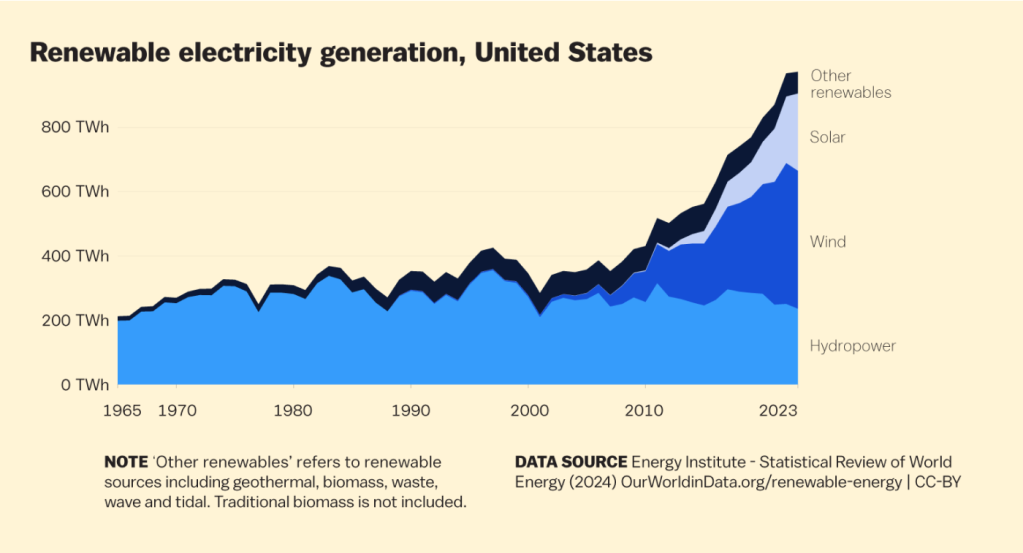

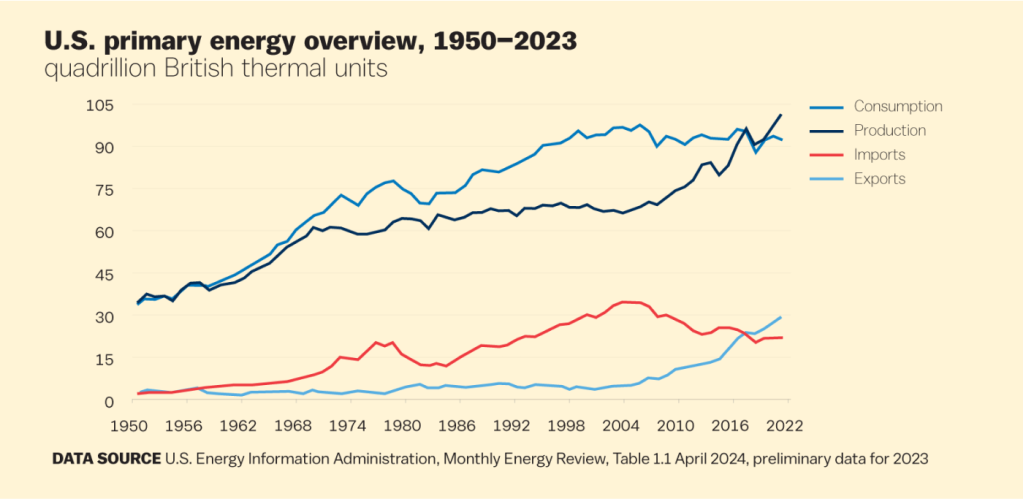

Until recently, the United States regularly consumed more energy than it produced, requiring it to import energy from abroad, elevating costs for working families, and threatening our national security. Now, thanks to the progress we’ve made under the Biden-Harris Administration, America is more energy secure and independent than ever before, with record energy production.56 America has been a net exporter of oil every single month for the last three years,57 and the gap between the amount of energy America produces and the amount of energy it consumes has never been greater.58 Prices at the pump have been falling for consumers and are approaching a three-year low.59 And, the United States has secured these achievements all while driving down emissions from the power sector.60 All of this is helping to power America now and further our edge in investing in clean energy sources and technologies.

A NEW WAY FORWARD:

What Vice President Harris and Governor Walz Will Do

Vice President Harris and Governor Walz will work to lower household energy costs and create millions of new jobs, while tackling the climate crisis, protecting public lands and public health, and holding polluters accountable to secure clean air and clean water for all. They will also safeguard America’s energy security.

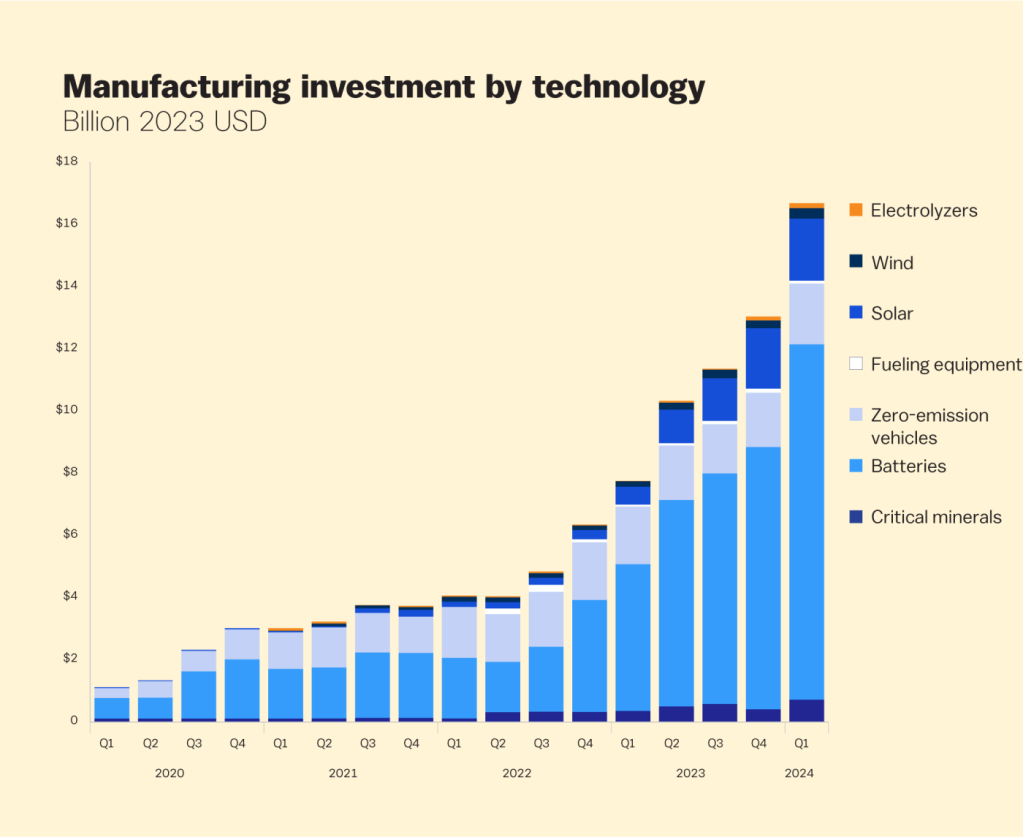

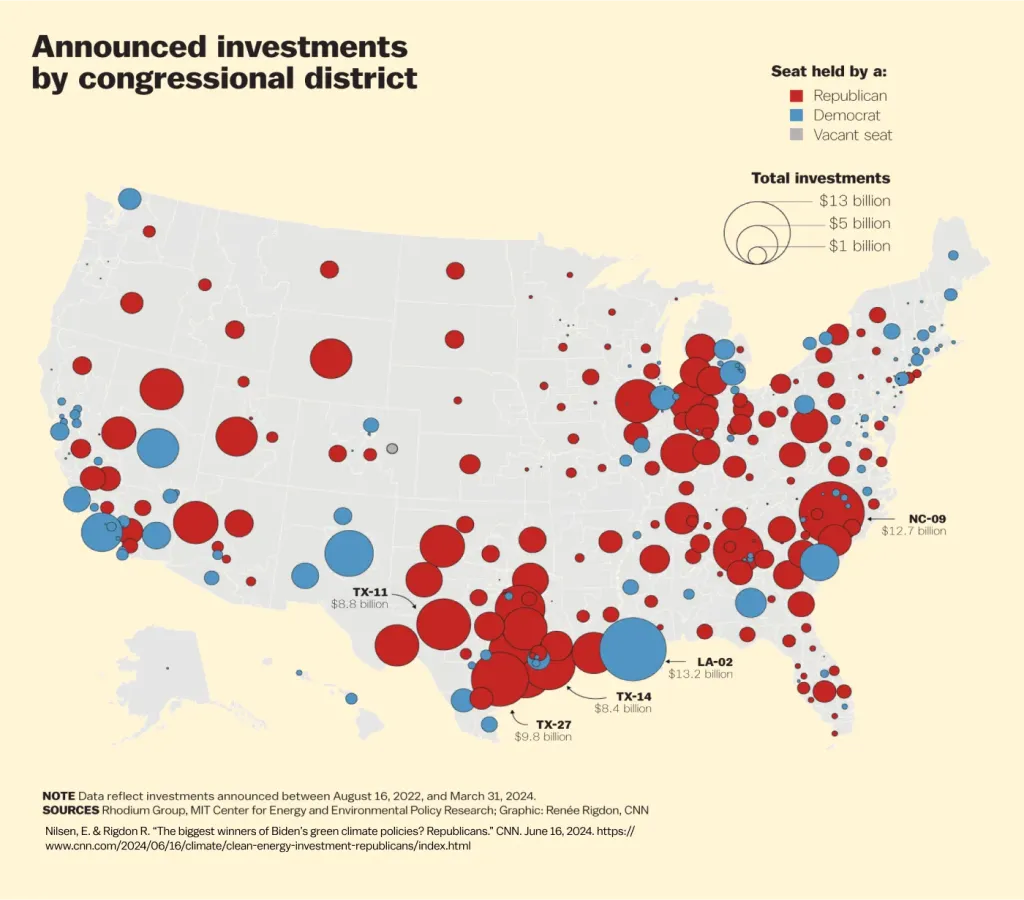

A Harris-Walz Administration will do this by continuing to invest in a thriving clean energy economy and helping realize the full potential of those investments by cutting red tape so that clean energy projects are completed quickly and efficiently in a manner that protects our environment and public health. Since the Inflation Reduction Act was passed, companies have already announced more than $265 billion in clean energy investments creating more than 330,00061 new jobs. As a result of these investments, national battery storage capacity is projected to double in 2024,62 solar module manufacturing capacity is going to be more than five times higher in 2024 than just three years earlier,63 and wind energy production will reach a record high in 2024.64 Today, U.S. energy production across a diverse set of sources, including natural gas and renewable technologies, is at historic levels, and the Vice President remains committed to supporting U.S. energy production growth so that we never again have to rely on foreign oil.

In addition to increasing energy production, Vice President Harris and Governor Walz will build on efforts to directly lower home energy costs for working families. Thanks to tax credits on home energy technologies in the Inflation Reduction Act, more than 3.4 million American families saved $8.4 billion in 2023. These tax credits can save families up to 30 percent off heat pumps, insulation, rooftop solar, and other clean energy technologies. The Treasury Department estimates that as of May 2024 these tax credits were saving applicable households around $5,000 per year.65 In addition, Vice President Harris has led efforts to expand the Low Income Home Energy Assistance Program, securing more than $22 billion to catalyze financial assistance for households across the country to help them maintain safe and healthy indoor temperatures.66 As President, she will continue that work to lower American families’ energy costs.

Vice President Harris and Governor Walz will also unlock upgrades, efficiencies, and faster construction of a lower-cost and more resilient electrical grid to speed up deployment of cutting-edge technologies that are critical to producing and distributing more energy, providing resilience to climate disasters, and bringing down costs.

Donald Trump wants to drag America back and cede the future of energy technology to China. He will roll back investments in cutting edge technologies that are powering America’s future, driving up costs for families, shipping good-paying jobs overseas, and threatening America’s security.67 Vice President Harris and Governor Walz know that we will not go back. We will invest in building the energy industries of the future here in the United States, keeping the well-paid union jobs of the future here at home.

LOWERING COSTS BY INVESTING IN AMERICAN ENERGY

Thanks to the Inflation Reduction Act’s Production Tax Credit for solar energy, Florida Power & Light (FPL) will refund its 5.8 million customers roughly $400 million. FPL is building more solar projects across Florida as part of the country’s largest solar expansion.

In Minnesota, Xcel estimated that the Inflation Reduction Act could generate $1.4B in savings for its customers over the next ten years.

In Wisconsin, WEC Energy Group added $2.4 billion to its investment plan for renewable energy over the next 5 years due in part to the Inflation Reduction Act. The company estimates that the investments in renewables will save customers roughly $2 billion over the long term.

Households that install an electric heat pump to heat and cool their home are eligible for a tax credit of up to $2,000, and can save an average of more than $500 per year on energy bills.

Under the Inflation Reduction Act, families who make other improvements to home energy efficiency can receive up to $1,200 per year in total tax credits, including up to $500 for doors, $600 for windows, $150 for a home energy audit, and 30 percent off the cost of new insulation.

Families who install rooftop solar or battery storage are eligible for a tax credit worth up to 30 percent of the cost of the installation while also saving almost $400 per year on energy bills.

SOURCE The White House. “FACT SHEET: One Year In, President Biden’s Inflation Reduction Act is Driving Historic Climate Action and Investing in America to Create Good Paying Jobs and Reduce Costs.” August 16, 2023. https://www.whitehouse.gov/briefing-room/statements-releases/2023/08/16/fact-sheet-one-year-in-president-bidens-inflation-reduction-act-is-driving-historic-climate-action-and-investing-in-america-to-create-good-paying-jobs-and-reduce-costs.

Too many American families struggle with the added burden of junk fees, scams, and fraud. These practices are costly. For example, junk fees— the hidden fees that are often tacked on to airline, hotel, entertainment, cable and other bills but that don’t show up until the very end of the transaction—distort competition and lead to customers paying more. The average household pays more than $650 in junk fees annually, costing a cumulative $90 billion or more across the economy.68 Vice President Harris and Governor Walz will stand up for Americans by making sure that they are not being scammed or swindled out of their hard-earned savings.

A NEW WAY FORWARD:

What Vice President Harris and Governor Walz Will Do

Vice President Harris has a long history of fighting for consumers. As Attorney General of California, she stood up to bad actors when they were ripping people off. Her Mortgage Fraud Strike Force helped to target scams, predatory lending, and deceptive marketing.69 She also worked to protect seniors from abuse and fraud by educating them about risks and the legal protections they are entitled to. As San Francisco’s District Attorney, she also prosecuted elder fraud cases.

Under her leadership as Vice President, the Administration has launched a historic effort to crack down on junk fees and save consumers time and money.70 This includes rules to ban junk fees across the board71 and make it as easy to cancel a subscription as it is to subscribe.72 The Department of Transportation, Consumer Financial Protection Bureau, and other agencies are also fighting junk fees. The Council of Economic Advisers recently estimated that just the actions undertaken by the Consumer Financial Protection Bureau will save Americans nearly $20 billion per year going forward.73

A Harris-Walz Administration will fight to protect American consumers. They will continue to take on the everyday hassles that waste Americans’ time and money, whether these be subscriptions, insurance claims, or other types of customer service doom loops and dead ends. They will also continue the work to eliminate junk fees and ensure their disclosure, and robustly address scams of all kinds from robocalls and texts to financial fraud, particularly those that target seniors.

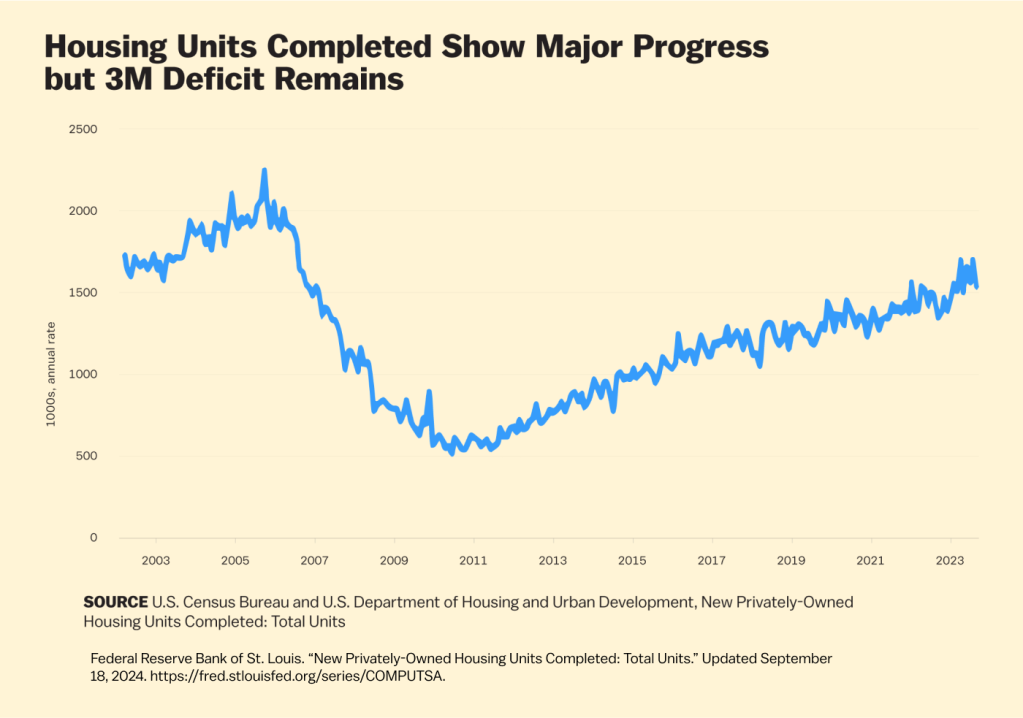

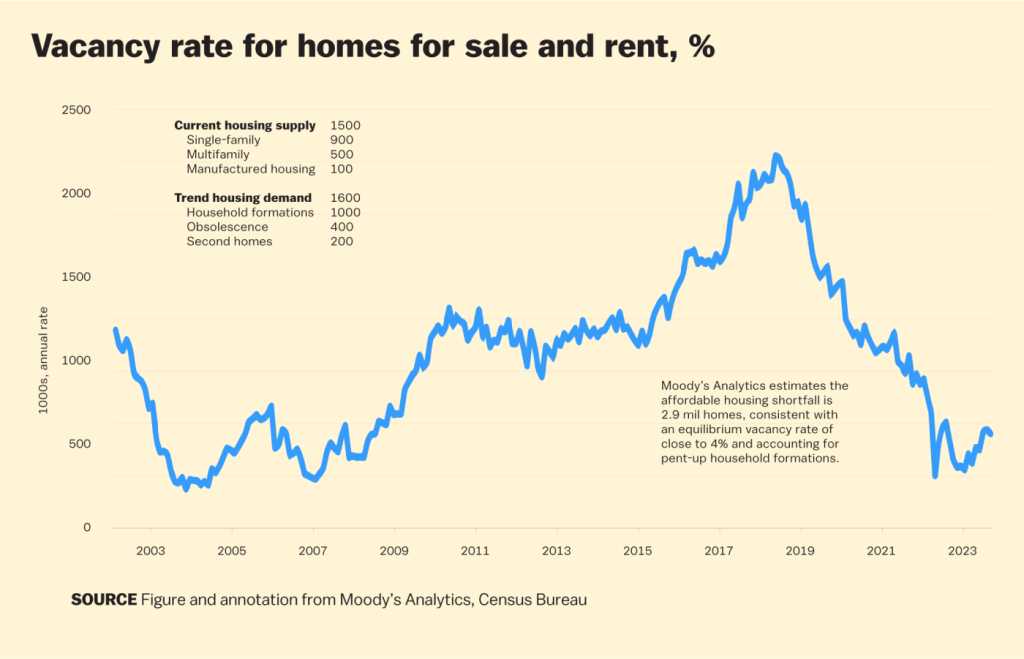

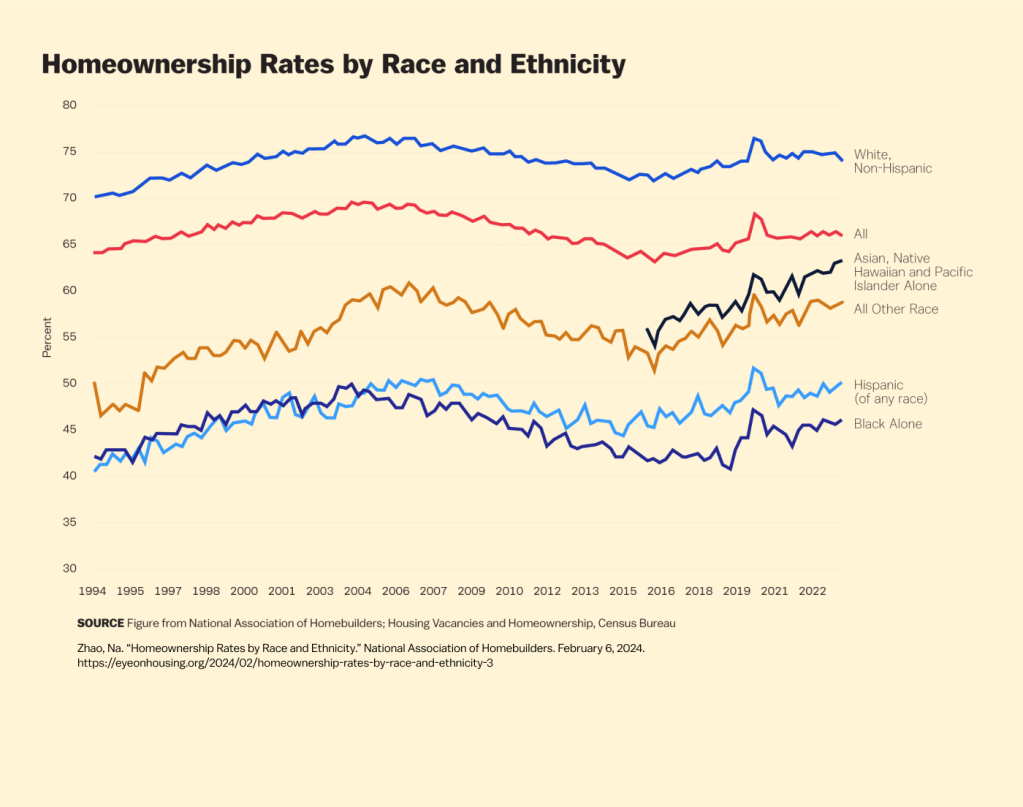

Vice President Harris knows that a house is more than a home—it represents financial security and an opportunity to build intergenerational wealth. Economists agree that expanding the supply of housing and increasing access to homeownership are two of the most central challenges for lowering household costs and creating opportunity for economic mobility and wealth creation. Over the past 15 years, following the global financial crisis, housing supply in the United States has significantly lagged behind demand.

This negative trend accelerated under Donald Trump’s administration, creating a shortfall of nearly 3 million affordable homes that has pushed up prices and made it harder for Americans to buy their first homes.74 For too long, American homebuilders have focused too much on the upper end of the housing market and built too few homes that first-time homebuyers can afford to purchase.75 While total housing units completed are up 44 percent from before the pandemic, and apartment completions will hit record levels this year—a trend that is helping to slow rent price growth across the country—solving this crisis will take a significant new mobilization to build supply and bring down housing costs.76

A NEW WAY FORWARD:

What Vice President Harris and Governor Walz Will Do

I. MAKING THE MOST SIGNIFICANT EFFORT TO EXPAND HOUSING SUPPLY SINCE WORLD WAR II

Experts agree that Vice President Harris’s plan will boost supply to help reduce costs for renters and homeowners. The President of the National Housing Coalition called Vice President Harris’s plan “detailed, serious, and impactful.”77 The Chief Economist of Moody’s Analytics described the plan as “the most aggressive supply-side push since the national investment in housing that followed World War II.”78 And the National Association of Homebuilders said her plan will “help builders to construct badly needed new homes and apartments.”79

1. Unlocking 1.2 million new affordable rental homes through historic incentives for the private sector.

As the demand for affordable housing continues to outstrip supply, the Census Bureau has reported that more than 21 million American renter households spend more than 30 percent of their income on rent—representing almost half of the renting households in the country.80 That’s more than double the share that had a similar rent burden in 1960.81

The most significant existing federal policy lever to address the affordable housing crisis is the Low-Income Housing Tax Credit (LIHTC), a tax credit that helps make it financially viable for private and non-profit developers to build affordable rental housing. This program works by helping developers cover the large upfront costs that come with building affordable units. Vice President Harris will unlock the potential of the building industry by expanding this proven tax credit to significantly expand affordable rental supply by more than 1.2 million new affordable homes, which will reduce rental prices. By passing a historic expansion of the LIHTC program, Vice President Harris will unlock the full potential of America’s building sector to provide an affordable rental home to every American who needs one.

2. Creating a new tax credit to rehabilitate affordable housing for homeowners who want to stay in their communities.

There are currently no federal tax incentives to help homeowners rehabilitate their homes and keep them affordable, nor to support the construction of affordable homes that will be owner-occupied. As a result, fewer new homes are constructed in distressed communities, and a lack of resources results in existing homes falling into disrepair, sometimes trapping these communities in a downward spiral.

Vice President Harris would fill this gap by creating a new Neighborhood Homes Tax Credit, which would support the new construction or rehabilitation of over 400,000 owner-occupied homes in lower income communities. As with the LIHTC program, each state would receive an allocation of Neighborhood Homes Tax Credits that would then be allocated to specific projects, calculated based on the amount of credit needed to make a construction or a preservation project in a particular community financially viable. The credit would only be available for single-family affordable homes that will be occupied by the owner, with the goal of supporting individuals or families that wish to set down roots in a community—not supporting private equity homebuyers that simply seek to turn a profit.

3. Building up supply through the first-ever tax incentive for building affordable homes for first-time homebuyers.

For decades, the United States has failed to build enough affordable homes for first-time homebuyers to keep up with demand, making it harder for them to enter the market. In the 1970s, the construction of these homes averaged more than 400,000 per year, compared with the 55,000 new entry-level homes completed each year throughout the 2010s.82 Moody’s finds that, even as the building of new homes reached record levels in 2023, “homebuilding has been at the higher end of the housing market. Demand by higher-income and wealthy households has been much stronger, and the higher house prices and rents that builders can charge these households have been a strong incentive to build more. The margins that builders could get from building affordable housing have been too low to incent the investment, with pricing too low to adequately clear the high fixed costs of building.”83

That’s why Vice President Harris is proposing the first-ever tax cut specifically targeted at encouraging homebuilders to build affordable homes for first-time homebuyers. This would provide significant tax relief for homebuilders who build homes sold to working families and meaning- fully change the economics of building homes that are within reach for younger families. This would complement the Neighborhood Homes Tax Credit, which encourages investment in homes that would otherwise be too costly or difficult to develop or rehabilitate. The National Association of Homebuilders commended this proposal, noting that it will “help builders to construct badly needed new homes and apartments.”84

4. Launching a $40 Billion Local Innovation Fund for Housing Expansion

While it is critical to have national incentives to build more homes and rental housing, state and local regulations can be a barrier to building more. Vice President Harris’s plan would provide state and local governments, and private developers and homebuilders, funds to invest in innovative strategies to expand the housing supply. This could include financing the construction of new housing paired with efforts to reduce regulatory burden and cut red tape, employing innovative building and construction techniques to lower costs, and using self-sustaining financing mechanisms to scale new housing construction. This will be a results-driven innovation fund with one core requirement: state and local governments must show that they will deliver results in building rental properties and homes that are affordable. Simultaneously, Vice President Harris will continue working to facilitate mass transit-oriented development and energy efficient homes to lower costs.

Vice President Harris cast the tie-breaking vote to pass the American Rescue Plan, which showed that state and local governments can build innovative affordable housing developments and offer the creative answers needed to address the affordable housing crisis. State and local governments invested recovery funds to build new and refurbish affordable housing through innovative investments.

For example:

II. LOWERING COSTS BY TAKING ON ABUSIVE CORPORATE LANDLORDS

1. Taking on algorithmic price fixing, which distort markets, and ending unfair practices that help large corporate landlords dramatically raise rents.

Large corporate landlords have increasingly used private equity–backed price-setting tools to dramatically raise rents in communities across the country. During the pandemic, many landlords of large multi-family units used these price-setting tools to institute dramatic rent increases. These services are centered around increasing landlord yield and pushing their pricing power. They can increase profit margins by raising rents, even if it means more apartments are vacant. One major price-setting company bragged that their rent-setting software was “driving” significant rent increases—noting that few land- lords would be “willing to actually raise rents double digits within a single month by doing it manually.”89

That’s why Vice President Harris is calling on Congress to pass the Preventing the Algorithmic Facilitation of Rental Housing Cartels Act, to crack down on companies that contribute to surging rent prices by making these unfair practices illegal under antitrust laws.

2. Stopping Wall Street investors from buying up and marking up homes in bulk.

Community after community feels taken advantage of by Wall Street investors and corporate landlords who have bought thousands of single-family homes during recent downturns. The “share of investor purchases” made by large investors with portfolios of 100 properties or more grew from 14 percent in September 2020 to 26 percent in September 2021, according to the Joint Center for Housing Studies.90 In 2021, large institutional investors bought 28 percent of homes in Texas and 19 percent in Georgia (including 25 percent of purchases in Atlanta).91 Research from the Urban Institute finds that large corporate investors “may file for eviction more frequently than local owners with smaller portfolios.”92 Further, large institutional investors disproportionately buy up homes in communities of color and low- and moderate- income communities. The National Association of Retailers found that “the median price of properties purchased by institutional buyers in 2021 was typically 26 percent lower than the state median prices,” and that institutional homebuyers disproportionately bought homes in Black communities, “with twice as many Black households in markets with higher share of institutional buyers.”93

That’s why Vice President Harris is calling on Congress to pass the Stop Predatory Investing Act, to curtail these practices by removing key tax benefits for major investors that acquire large numbers of single-family rental homes.

III. EXPANDING HOMEOWNERSHIP WITH HISTORIC $25,000 DOWN-PAYMENT ASSISTANCE FOR FIRST-TIME HOMEBUYERS.

Many Americans work hard at their jobs, save, and pay their rent on time month after month. But they cannot save enough, after paying their rent and other bills, to save for a down payment—denying them a shot at owning a home and building wealth. As Vice President Harris’s plan starts to expand the supply of entry-level homes, she will, during her first term, provide working families who have paid their rent on time for two years and are buying their first home up to $25,000 in down-payment assistance, with more generous support for those whose parents did not own a home.

There’s no question that saving up enough to afford a down payment is often the most significant barrier for first-time homebuyers. Some first-time homebuyers can rely on family help for their down-payment: between 20 percent and 30 percent of first-time homebuyers today use a gift or loan from their family or friends.94 But for millions of Americans, working hard year after year and making their rent payments on time, homeownership feels far out of reach because they cannot accumulate the tens of thousands of dollars in down-payment savings needed for a home purchase.

More than two-thirds of renters identify saving enough for a down-payment as a barrier to buying a home.95 For a significant number of first-time homebuyers, up to $25,000 in down-payment assistance will mean the difference between closing on a first home and simply paying rent year after year with no end in sight. The Urban Institute found that down-payment assistance has become such an important part of the “post-Great Recession” housing finance scheme that by 2019 “nearly three-quarters of the single-family mortgages” from state Housing Finance Agencies used down-payment assistance.96

Recently we have seen federal resources used by states and local governments that provide more examples of successful and life-changing down-payment programs, like the Detroit Down Payment Assistance Program, which is providing more than 700 working Detroit renters with access to up to $25,000 for down payment assistance to buy their first home.97 Numerous other places from the state of Nevada to cities like Louisville, Kentucky; Greenbelt, Maryland; and Riverside County, California, are investing these funds to pilot or expand down-payment assistance.

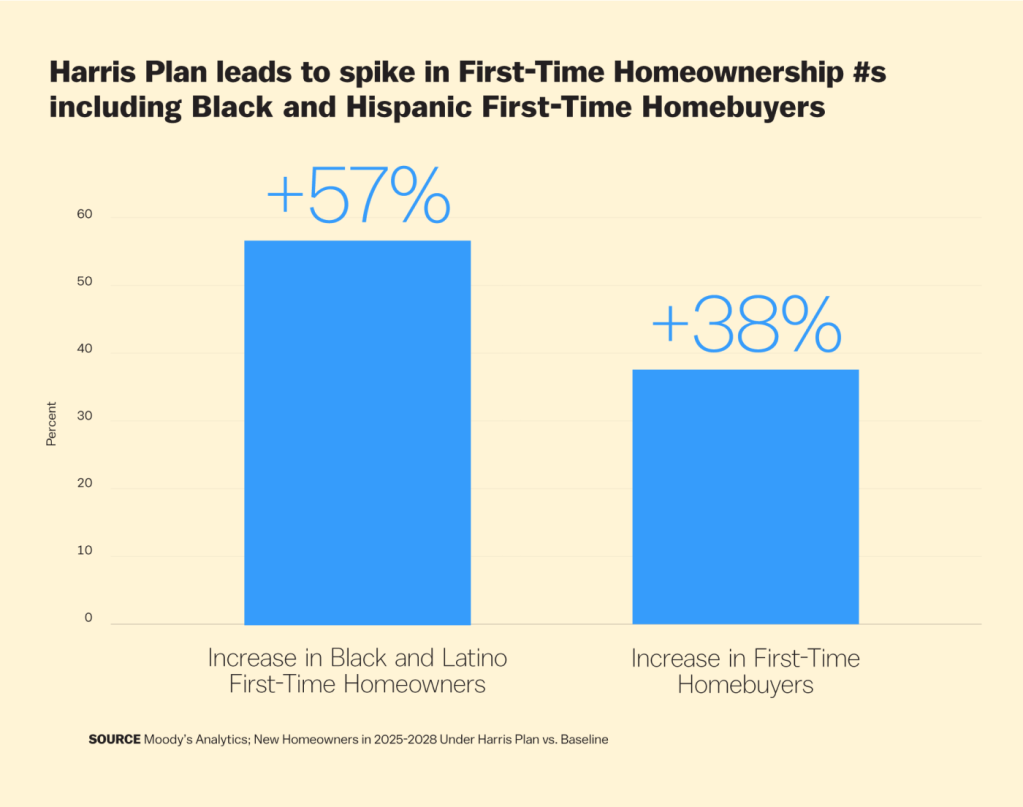

With Vice President Harris’s plan, millions of renters would be able to buy their first homes. Moody’s estimates that Vice President Harris’s housing plan would close the affordable housing gap and lead to a historic 11.7 million more first-time homebuyers, including 2.75 million first-time Black and Latino homeowners. This is 3.2 million more first-time homebuyers and 1 million more Black and Latino first-time homebuyers than would take place without the Harris-Walz plan.

This proposal builds on the Biden-Harris Administration’s work to reduce barriers to homeownership based on medical debt and limited credit history. The Administration sought to recognize renters who regularly pay their rent on time, by incorporating a borrower’s positive rental payment history into the analysis for first-time homebuyers to qualify for Federal Housing Administration (FHA) loans that are underwritten by the federal government. The addition of positive rental history allowed FHA’s credit evaluation to be more comprehensive and equitable, enabling additional first-time homebuyers to qualify for FHA loans. In addition, Vice President Harris spearheaded work to prohibit medical bills from being included on credit reports, because the burden of medical debt and its impact on credit reports should not restrict access to housing.

Donald Trump—on the other hand—spent his career keeping the rent high and putting homeownership out of reach. As a landlord, he was sued by the Justice Department for turning away Black tenants.98 Then he tried to force people out of their affordable homes so he could charge higher prices.99 It’s no surprise that, as President, he tried to gut rental assistance and raise homeowners’ monthly mortgage payments. He tried to triple rents on the poorest Americans in federally subsidized housing—including low-wage workers, the elderly, and people with disabilities—putting 1 million children at risk of homelessness. Now, his Project 2025 agenda would further slash rental assistance by placing “maximum term limits” on rental assistance programs.

Trump’s Project 2025 agenda would also make it harder for many low- and middle-income families—predominantly first-time homebuyers and many of them people of color—to purchase a home. It would increase mortgage insurance premiums on many Federal Housing Administration (FHA)–backed loans—or those loans with a small down payment. On top of that, his Project 2025 agenda would charge 850,000 families $800 more each year by rolling back the Biden-Harris Administration’s action to reduce the insurance premium for FHA-insured mortgages.

If he returns to office, Trump will continue working to enrich himself and his wealthy friends at the expense of working people. He would drive up mortgage premiums by $1,200 a year for American families by privatizing Fannie Mae and Freddie Mac, government-sponsored enterprises that have long guaranteed the loans of middle-class Americans.100 Trump and his allies at Project 2025 would hand a payday to his wealthy friends who would benefit from privatization—at the expense of working families.

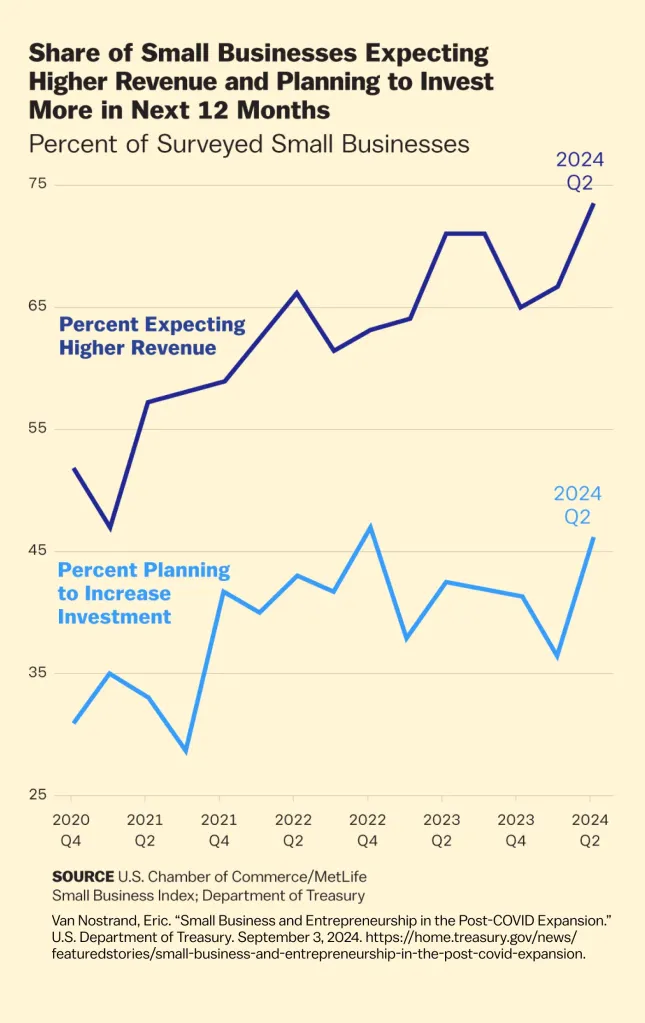

Small businesses and entrepreneurs—neighborhood shops, high-tech startups, small manufacturers, and more—are the engines of our economy.

Small businesses employ half of all private-sector workers—more than 60 million Americans.101 Since 2019, small businesses have created 70 percent of net new jobs, adding trillions of dollars to the U.S. economy.102 Throughout her career, Vice President Harris has championed policies that reward ambition and hard work by increasing access to capital and investing in small businesses, particularly in communities that have too often been over- looked. As Vice President, she established the Economic Opportunity Coalition, a historic public–private partnership that is investing tens of billions of dollars to create opportunity and wealth in historically underserved communities. And as Senator, she secured a transformative $12 billion for Community Development Financial Institutions and other community lenders, providing capital to small businesses in low- and moderate-income communities, both urban and rural, and in Indian Country.

Under Vice President Harris and President Biden’s leadership, entrepreneurship continues to surge, with a record 19 million new business applications.

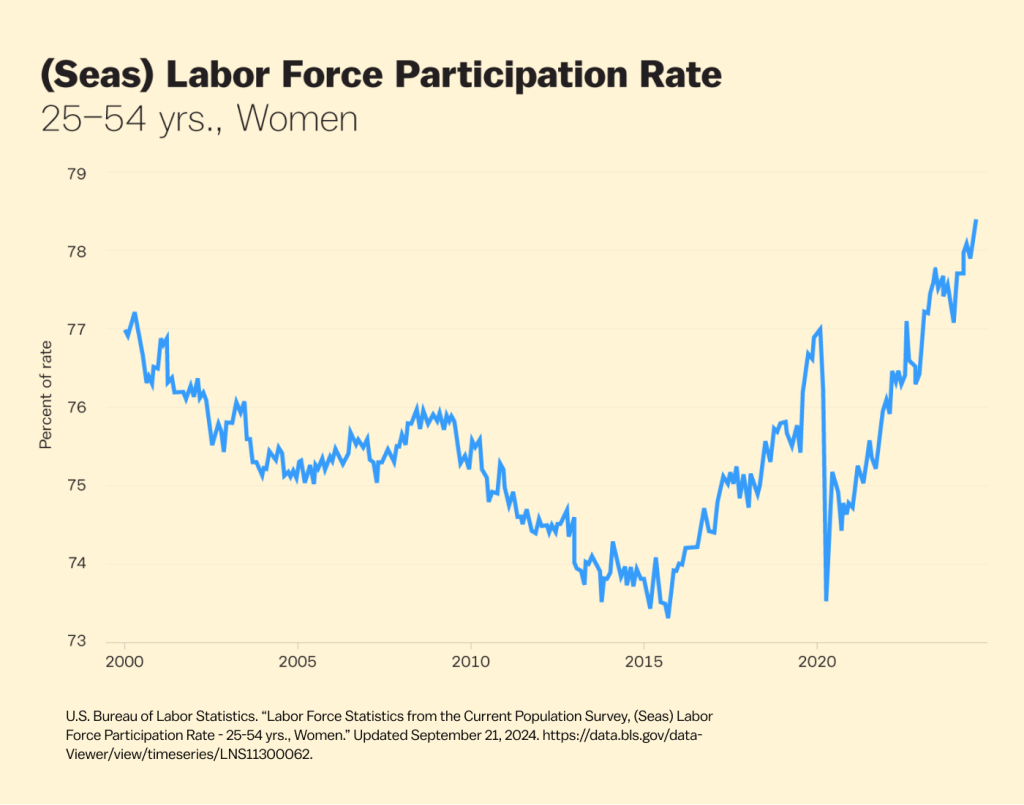

New business applications averaged 430,000 per month in 2024, 50 percent more than in 2019. Entrepreneurs are growing more diverse: 43 percent of self-employed Americans are female, more than ever before, and Black, Asian, and Hispanic shares of self-employed Americans are near all-time highs.103 Additionally, Black and Latino business-ownership rates are both growing at the highest levels in 30 years, and the number of SBA-backed loans to both Black-104 and Latino-owned businesses has doubled between FY 2020 and FY 2023.105 Loans and federal con- tracts to Asian American-owned small businesses are also on the rise and Vice President Harris is working to provide these businesses access to capital, including by launching the largest-ever direct Federal investment in small business incubators and accelerators—which funded efforts led by the Asian/Pacific Islander American Chamber of Commerce and other important incubator organizations.106 While progress has been made, Vice President Harris recognizes that there is more work to be done to help small businesses grow and succeed.

A NEW WAY FORWARD:

What Vice President Harris and Governor Walz Will Do

The Harris-Walz plan would:

THE HARRIS-WALZ PLAN FOR INNOVATION AND ENTREPRENEURSHIP.

Vice President Harris and Governor Walz will lift up small businesses and entrepreneurs, promote innovation, boost growth, and build wealth for the middle class. They will launch an ambitious plan to encourage 25 million Americans to take the first step toward starting a new business during the next four years, take on the everyday obstacles and red tape that can make it harder to grow a business, and drive economic growth all across America.

Setting a Goal to Launch a Record 25 Million Applications to Launch New Businesses in the Next Four Years

Starting a business is an act of optimism in America’s economic future. Small businesses are responsible for most of the net job creation for Americans over the last decade.107 Vice President Harris knows that with the right policies, we can give millions more Americans the confidence to take part in our long history as a nation of entrepreneurs. As Vice President, Kamala Harris led the Administration’s effort to help small businesses and entrepreneurs access billions of dollars in capital, driving growth in underserved communities across the country. She and Governor Walz will build on that success, setting a goal of 25 million new business applications by America’s entrepreneurs in their first term—exceeding the record 19 million new business applications already seen under the Biden-Harris Administration. Reaching Vice President Harris’s goal would mean 10 million more new business applications than Donald Trump saw during his term. And importantly, it would continue the needed progress to reverse the pre-pandemic trend of declining business dynamism108 that had reduced productivity growth,109 and kick-start a further revival in more young, small, and innovative firms.110

Helping More Entrepreneurs, Founders, and Innovators Start Up Their Businesses

Helping Entrepreneurs Get Their Ideas Off the Ground With a $50,000 Deduction for Startup Expenses—a Ten-Fold Increase. Entrepreneurs need to have access to capital to launch their ideas. New small businesses spend an average of $40,000111 to get set up during their first year of operations. To help give small businesses, entrepreneurs, and founders the confidence to make the investments they need to get off the ground, a Harris-Walz Administration will call for expanding the startup expense deduction from $5,000 to $50,000—and allow new businesses the flexibility to use the deduction immediately or in a future year to help reduce their taxes when they start to make a profit. For example, a small business that takes a loss in its first year can wait until future years to claim this deduction.

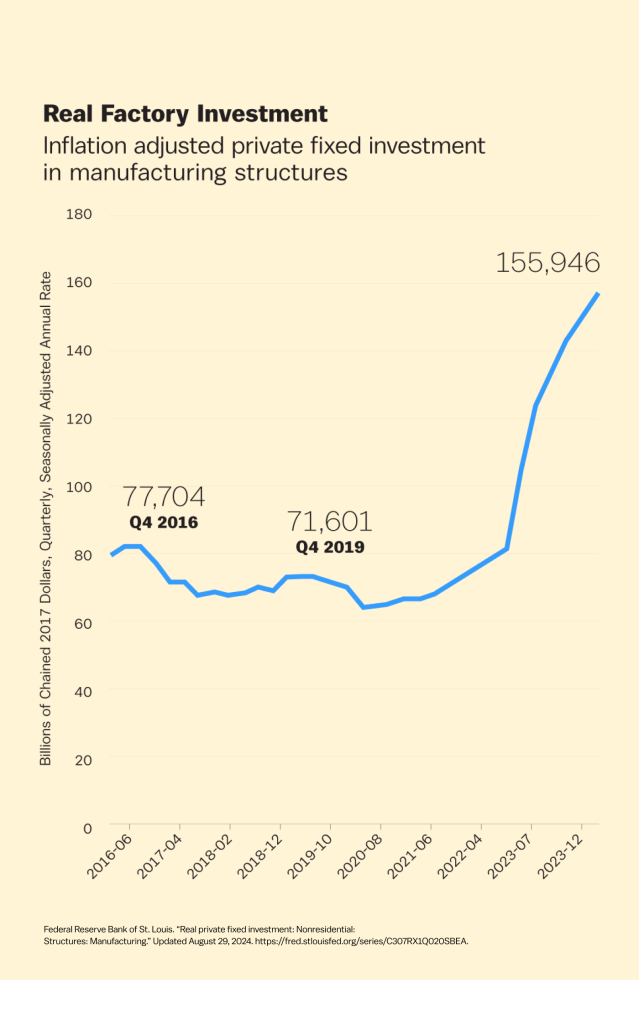

Supporting New Businesses and Entrepreneurs in Domestic Manufacturing and Advanced Industry. With the historic manufacturing and innovation renaissance spurred by the Biden-Harris Administration, we must continue to drive growth for small U.S. manufacturers, suppliers, and other businesses. Vice President Harris and Governor Walz are proposing to fund a network of new and existing federal, state, local, and private business incubators, and small business innovation hubs. This will be designed to help small businesses and local suppliers reap the broader benefits of investments in semiconductor factories,112 Tech Hubs,113 and more—everywhere from Wisconsin to New Hampshire to Arizona. Incubators will help small businesses and local suppliers access technical assistance, capital, and customers to start or expand their business. Hubs will help advanced manufacturers commercialize by connecting them to contracts and clients, national laboratories and federally funded research facilities, technical assistance, and funding. This network will draw from both existing and new federal, state, and local programs and be designed to work with the private sector to strengthen the competitiveness of U.S. manufacturing. These targeted proposals to encourage new business growth are closely aligned with Vice President Harris and Governor Walz’s plans to remove other barriers that com- monly prevent hard working Americans from taking a risk and starting a new business.

They will tackle health care costs that can keep Americans— especially those with pre-existing conditions—from launching a new business venture, by protecting the Affordable Care Act and its critical support for entrepreneurs and small business- es. They will make permanent the premium tax credits that are saving an average of $800 per year for millions of small business owners who get insurance from the ACA market- place,114 and they will work with states to forgive medical debt. They also have a plan—the boldest in a generation—to lower housing costs and support aspiring homeowners, helping give potential entrepreneurs the financial stability they need to start a business and hire workers.

Helping Small Businesses Expand and Grow Jobs

Launching a Small Business Expansion Fund to Help Entrepreneurs Grow Their Businesses and Create Jobs With Low- or Zero-Interest Loans. Small businesses and entrepreneurs fuel growth and jobs. Too often, however, a small business may be concerned about the time it takes to generate the revenue needed to make initial loan payments. This new fund would enable community banks and community development financial institutions (CDFIs) to cover interest costs while small businesses are expanding. This fund will help get accessible and affordable capital to those small businesses who want to locate, innovate, and create jobs in communities across the United States.

Allocate One-Third of Federal Contract Dollars to Small Businesses. Contracts to provide goods and services for the federal government can help small business owners build generational wealth and hire workers by providing sustained funding. Under the Vice President’s leadership, the Biden-Harris Administration set new records for contracting with small businesses by dedicating more than 28 percent, or nearly $179 billion, of federal contract dollars to small businesses in FY 2023.115 However, rural small businesses are awarded less than 2 percent of federal procurement dollars, even though they make up more than 11 percent of overall U.S. small businesses.116 A Harris-Walz Administration will expand contract opportunities for rural and other underserved small businesses by directing a goal of one-third of federal contract dollars to small businesses by the end of her first term in office.

Cutting Red Tape. Vice President Harris and Governor Walz are also focused on removing barriers that unnecessarily hold businesses back. Many regulations are essential to fairness, stability, and safety, but too many businesses cannot recruit the workers they need, set up their shop, or expand their companies across states because of outdated or patchwork regulations. A Harris-Walz Administration will address that by:

Investing in All of America. Opportunities to turn a good idea into a new small business should not be limited to those with connections to big banks or to those in just a few big cities that have traditionally attracted venture capital dollars. That’s why Vice President Harris has been fighting to support small businesses in middle America, rural areas, and underserved communities across the country. As a Senator, she created a new program to expand access to capital in underserved communities through Community Develop- ment Financial Institutions (CDFIs). As Vice President, she championed efforts to get more financing and venture capital to all communities and oversaw the Biden-Harris Administration’s initiative to connect more communities of color and rural Americans to affordable and reliable high- speed internet. A Harris-Walz Administration will help new and existing businesses scale their operations by:

American manufacturing is essential to rebuilding the middle class. Disinvestment in manufacturing communities, policy choices that facilitated outsourcing, and corporate decisions to deprioritize long-term supply chain resilience hollowed out American manufacturing leading the U.S. share of global manufacturing to decline from 25 percent in 1997 to 17 percent in 2021. This decline led the United States to stop producing some of the most advanced products such as semiconductors, which the U.S. went from producing 37 percent of to 12 percent over a similar period. As a result, American manufacturing communities suffered, jobs were lost, and our country was left vulnerable to disruptions of critical goods and inputs. Recent supply chain disruptions have laid bare the dangers of outsourced, overly brittle supply chains and the need for the United States to reinvest in its domestic industrial base. Whether it was shortages of semiconductors, snarled shipping lanes, or formula disruptions, a new direction was needed. It also made clear that a New Way Forward was needed for manufacturing workers.

In response, Vice President Harris worked with President Biden and Congress to pass the most monumental set of investments in American manufacturing in generations. Collectively, the Bipartisan Infrastructure Law, the CHIPS and Science Act, the Inflation Reduction Act, and the American Rescue Plan have catalyzed more than $900 billion of investments in manufacturing and related sectors.117 These investments span the full range of American industry, from automobile assembly lines, to broadband infrastructure, to semiconductors and clean energy technology.118 And President Biden and Vice President Harris took decisive actions to help American industry and workers reap the benefits of these investments: toughening implementation of the Buy American Act and creating a Made in America office in the Office of Management and Budget to establish effective oversight.

As a result, we have seen manufacturing jobs return to the United States. Donald Trump presided over the decline of this sector, losing an additional 178,000 manufacturing jobs by the end of his presidency, while the U.S. has already added over 700,000 manufacturing jobs under Vice President Harris, with many more to come as additional projects come online.119 Construction of new manufacturing facilities has already doubled, and the communities that have benefited the most are many of the same ones that were hit the hardest by the manufacturing decline—over 80 percent of the communities receiving new investments saw their manufacturing sectors shrink in the last two decades.120 And in 1,000 “left-behind counties,” jobs grew four times as fast under the Biden-Harris Administration as under Trump, the strongest period of job creation for those communities since the turn of the 21st century.121 Some of the greatest beneficiaries of this revitalization will be those Americans without college degrees, as the vast majority of jobs won’t require a degree.122

A NEW WAY FORWARD:

What Vice President Harris and Governor Walz Will Do

Vice President Harris and Governor Walz will sharpen America’s edge in sectors that are critical for our economic and national security. They will create an America Forward strategy to jumpstart a new era in American industry, by developing, manufacturing, and deploying technologies and manufacturing them at scale. This strategy will focus both on clean iron and steel—modernizing a traditional area of American strength—and emerging technologies essential for future American competitiveness including biomanufacturing, AI, aerospace, data centers, and clean energy. Their strategy includes both investing in emerging technologies and modernizing traditional industries. It will also encourage innovative technologies like AI and digital assets while protecting our consumers and investors.

Their transformational America Forward tax credit will be targeted at investment and job creation in key strategic industries. It will be structured as tax credits that prioritize doing right by American workers, protecting the right to organize and supporting investments that take place in longstanding manufacturing, farming, and energy communities. The types of investments that would benefit from the tax credit include:

Vice President Harris and Governor Walz will push America to build more—and faster— by cutting red tape. They know that it takes too long to build in America, and they support reforms so that projects are completed more quickly and efficiently, reflect community input, and protect our environment and public health. Thanks to Vice President Harris’s leadership, we’ve already made tremendous progress in accelerating new manufacturing projects with strong community buy-in. The Vice President cast the tie-breaking vote to secure funding under the Inflation Reduction Act to speed permitting review, helped finalize a rule to streamline the National Environmental Policy Act review process, and pushed to increase the number of projects that qualify for the simplest form of environmental review so that agencies can expedite projects that will lower costs without harming the environment. And companies’ investments in new manufacturing construction projects have doubled— reflecting businesses’ confidence that their investments will pay off. When these projects are completed, businesses can hire and fill these factories with workers.

Now, we must push for projects to stay on track and finish on time, so America can keep moving forward. A Harris-Walz Administration will be laser-focused on accelerating projects and unleashing the full potential of American industry by cutting red tape that slows projects down, including through permitting reform.

Vice President Harris and Governor Walz will also fight for a level playing field with China and other global competitors. The America Forward tax credit will invest tens of billions to position the United States to compete and win in the 21st century. Vice President Harris won’t let other countries such as China undermine those investments in our workers and U.S. manufacturing. The Biden-Harris Administration has stood up to China when it breaks the rules—including when China has threatened American workers and businesses by engaging in unfair trade practices such as flooding the global marketplace with artificially low-priced goods or engaging in forced technology transfers or intellectual property theft. As President, she will not hesitate to take action when our workers and businesses are threatened, whether it is in shipbuilding, electric vehicles, or intellectual property. She believes in upholding and strengthening international economic rules and norms that protect fair trade and create predictability and stability.

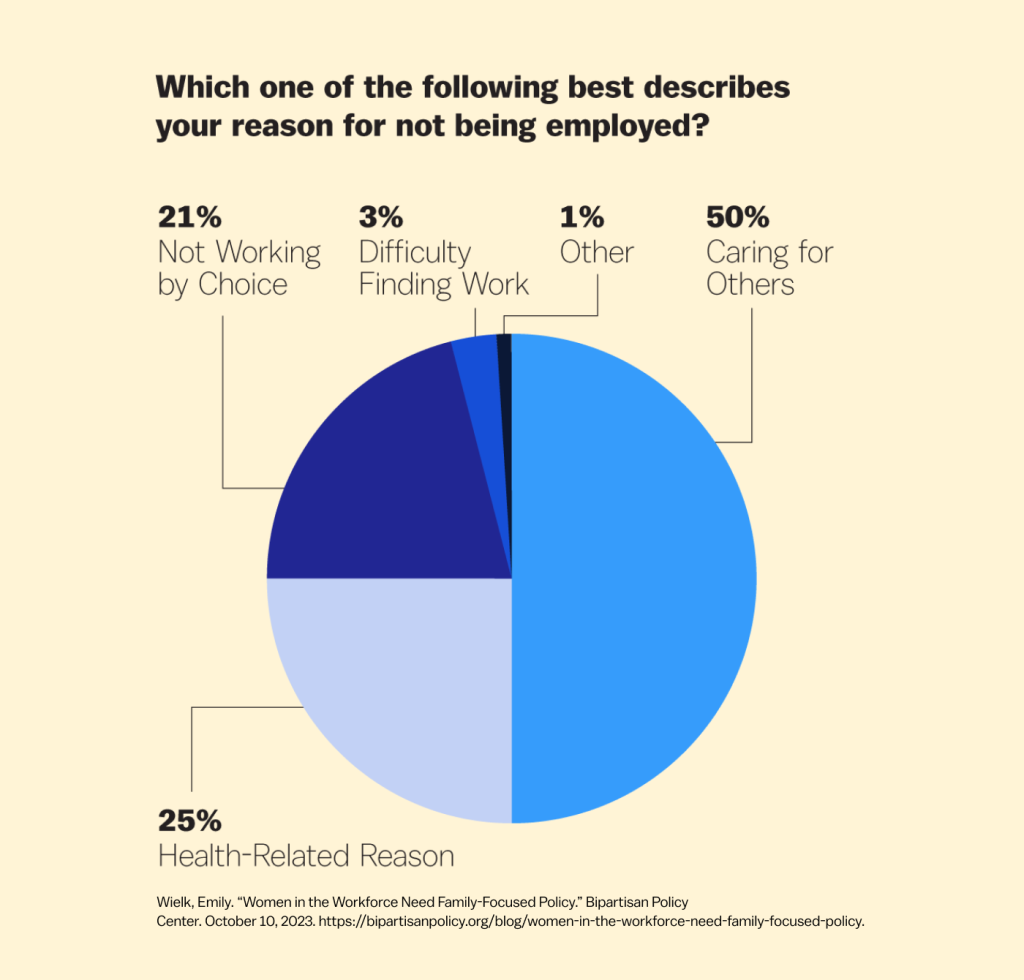

Vice President Harris and Governor Walz will make many of the jobs their Opportunity Economy creates available to those without a college degree. For too long, our nation has recognized only one path to success: a four-year college degree. Vice President Harris and Governor Walz believe that anyone with the skills to do a job should be able to get it regardless of their degree status. They will address barriers holding back workers without a college degree from working in roles that they deserve and earning a good salary where they live.

They will also do their part to open up opportunity by eliminating four-year degree requirements that are not needed for half a million federal jobs. They will challenge the business community to step up, too, by providing clear pathways to jobs without imposing unnecessary degree requirements. They will encourage the private sector to work with unions, school districts, community colleges, governors, and mayors on Registered Apprenticeships, pre-apprenticeships, joint labor-management partnerships, and creative public-private efforts to open these pathways. And they remain committed to cutting red tape by reducing barriers to occupational licensing across state lines. At the same time, they will also continue to strengthen America’s STEM education so that, for jobs that do require certain types of training, we are preparing the next generation of researchers to compete globally.

Meanwhile, Donald Trump failed American Workers. After grandiose bluster and promises, Trump abandoned American manufacturing and established himself as one of the biggest losers of American manufacturing in our history. He failed to pass an infrastructure plan that could have increased demand for American manufacturing industries like steel. He ceded the production of the cars of the future to China. He passed a $2 trillion tax law that gave the largest multinational companies enormous tax cuts and created new incentives to ship jobs overseas.123 He waged a disastrous trade war with China that cost American jobs, worked against American businesses, failed to increase exports, and stunted our economic growth.124 He passed no manufacturing legislation. He took no action to stop auto plant closures in places like Lordstown, Ohio.125 The result: close to 200,000 American manufacturing workers lost their jobs under Trump’s watch. Even excluding the jobs lost during the pandemic, manufacturing jobs still grew more slowly under Trump than they have during the manufacturing comeback spurred by Vice President Harris’s leadership.126

I. PATHWAYS TO JOBS FOR ALL AMERICANS

Workers should have many paths to success, not just a four-year college degree. Too many qualified workers have career opportunities blocked by unnecessary degree requirements. The Brookings Institution found that degree requirements significantly affect around 70 million workers, who are unable to obtain jobs they are otherwise qualified for. These workers gain relevant skills through other means, such as apprenticeships, community college programs, military service, and on-the-job experience.127

Vice President Harris and Governor Walz are committed to ending unnecessary degree requirements so that good-paying jobs are available to all Americans, not just those with college degrees. They will support all viable, high-quality paths to good jobs, such as registered apprenticeships, joint labor-management programs, innovative partnerships between school districts and industries, and career and technical education programs.

As President, she will get rid of unnecessary degree requirements for hundreds of thousands of federal jobs and will challenge the private sector and state and local governments to take similar action.

Vice President Harris and Governor Walz are also working to increase workers’ wages. They will fight to raise the minimum wage, end the sub-minimum wage for tipped workers and people with disabilities, and eliminate taxes on tips for service and hospitality workers. This will help put more money into workers’ pockets.

Vice President Harris and President Biden have expanded Registered Apprenticeships, promoted skills-based hiring, and created jobs for workers without four-year college degrees. The Biden-Harris Administration invested more than $750 million in expanding Registered Apprenticeships and pre-apprenticeship programs. Registered Apprenticeships are industry-driven, high-quality career pathways where employers can develop and prepare their future workforce, and individuals can obtain paid work experience. Under the Biden-Harris Administration, almost 1 million Registered Apprentices worked across the government and private sector and new apprenticeship programs increased by 10 percent.

The Biden-Harris Administration has fueled a manufac- turing comeback, driven by skill-based labor. Experts found that roughly 70 percent of the jobs created by the Inflation Reduction Act (IRA), the Bipartisan Infrastructure Law (BIL), and the CHIPS and Science Act will be for workers without four-year college degrees, a significantly higher share than for the overall U.S. labor market.128 Through the Low or No Emission Grant Program and Workforce Hubs, the Biden-Harris Administration is creating pathways into good construction jobs and training skilled construction trades workers to meet demand.

GENERATING PATHWAYS INTO GROWING INDUSTRIES

The Biden-Harris Administration has established a number of programs to invest in good-paying, skill-based jobs:

The Department of Transportation committed $168 million to train mechanics through the Low or No Emission Grant Program and approved an additional $40 million dollars from funds to create pathways into good construction jobs.